Dollar Tree 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Silver Anniversary

GOLD MEDAL RESULTS

DOLLAR TREE, INC. • 2010 ANNUAL REPORT

Table of contents

-

Page 1

Silver Anniversary GOLD MEDAL RESULTS DOLLAR TREE, INC. • 2010 ANNUAL REPORT -

Page 2

..., fun, friendly and convenient shopping environment. Dollar Tree operates more than 4,100 stores, which are located across the 48 contiguous United States and four Canadian provinces, supported by a coast-to-coast logistics network and over 60,000 associates. The Company is the destination for value... -

Page 3

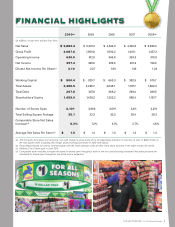

.... (c) Reï¬,ects 3 for 2 stock split in June 2010. (d) Comparable store net sales compare net sales for stores open throughout each of the two periods being compared. Net sales per store are calculated for stores open throughout the entire period presented. DOLLAR TREE, INC. ♦ 2010 Annual Report 1 -

Page 4

..., for twenty-ï¬ve years, customers have come to expect new, fresh items and surprising values every time they visit a Dollar Tree store. Our unique merchandise model provides us greater control of our mix and as a result, our margins. In fact, margin at Dollar Tree is generally a function of the... -

Page 5

... year with 4,101 stores. The new store class of 2010 averaged approximately 10,000 square feet, similar to the class of 2009. Our plan for 2011 includes 300 new stores and 75 relocations for a total of 375 projects. Better Stores Along with expanding the number of stores, we are focused on operating... -

Page 6

... to offer Dollar Tree values to more customers, including organizations, small businesses, and individual customers planning events. Dollar Tree Direct is off to a great start. We see major potential to grow this business. In 2010, we expanded our assortment, increased the number of items available... -

Page 7

... store productivity, developing new retail formats, expanding into new markets and adding new channels of distribution. These investments bring greater opportunities for our associates to grow and develop their skills, while expanding overall employment opportunities. Dollar Tree's values have... -

Page 8

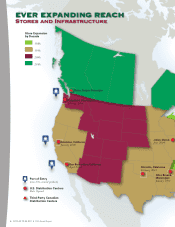

... June 2004 S San Bernardino, California A April 2010 Marietta, Oklahoma February 2003 Port of Entry (non-U.S.-sourced products) U.S. Distribution Centers Date Opened Third-Party Canadian Distribution Centers nch Olive Branch, Mississippi January 1999 6 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 9

... supply chain, improve merchandise ï¬,ow and increase inventory turns. Number of Stores Open at Year End 4,101 3,806 3,411 3,219 3,591 Inventory Turns Mississauga, ss Ontario 4.1 3.5 3.7 3.8 4.2 Briar Creek, k, Pennsylvania nia August 2001 Chesapeake, Virginia January 1998 Savannah, Georgia... -

Page 10

Frozen and refrigerated products are now available in 45% of our stores. SNAP is accepted in over 86% of our stores in the U.S.A. Stores with Freezers and Coolers 1,844 1,423 1,209 1,058 694 '06 '07 '08 '09 '10 8 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 11

..., seasonal merchandise, and party supplies. It is the one chain that offers these and other items to customers coast-to-coast with each item priced at $1 - or less - every day! Dollar Tree stores offer an ever-changing assortment of products - each for $1 - and a fun, friendly, convenient shopping... -

Page 12

...to open 35 new Deal$ stores in 2011. Dollar Tree Direct, our e-commerce business, is an additional channel of distribution to our customers. The website, www.dollartree.com, offers extreme value merchandise for people in need of large quantities. With each single item just $1.00 and free shipping to... -

Page 13

Customer Transactions (in Millions) 748 675 597 522 551 '06 '07 '08 '09 '10 Through continuous growth and reinvention, Dollar Tree strives to ï¬nd more ways to provide more value to more customers every day. -

Page 14

...to new and existing shopping centers, with more than 185,000 customer visits per average store in 2010. Our store expansion has created thousands of jobs across America. And, we generate millions of dollars in sales tax revenue across the country each year. Dollar Tree also supports the communities... -

Page 15

... seasons and the effect of a later Easter in 2011; • the effect that expanding tender types accepted by our stores will have on sales; • the capabilities of our inventory supply chain technology and other new systems; • the future reliability of, and cost associated with, our sources of supply... -

Page 16

...and Saskatchewan. These stores offer a wide assortment of quality general merchandise, contemporary seasonal goods and everyday consumables, all priced at $1.25 (CAD) or less. This is our ï¬rst expansion of retail operations outside of the United States. 14 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 17

... 2010, the Company's Board of Directors approved a 3-for-2 stock split in the form of a 50% common stock dividend. New shares were distributed on June 24, 2010 to shareholders of record as of the close of business on June 10, 2010. As a result, all share and per share data in this Annual Report have... -

Page 18

... half of 2010; however, we offset the increase in payroll costs through increased productivity and continued efï¬ciencies in product ï¬,ow to our stores. We must continue to control our merchandise costs, inventory levels and our general and administrative expenses as increases in these line items... -

Page 19

...inventory, operating income margin was 11.1% due to the reasons discussed above. Income Taxes. Our effective tax rate was 36.9% in 2010 and 2009. January 30, 2010 240 - New stores Acquired stores Expanded or relocated stores Closed stores 235 86 95 (26) 75 (25) Of the 2.9 million selling square... -

Page 20

... the current year was the result of the favorable settlement of several state tax audits in 2008 and a higher blended state tax rate in 2009. January 31, 2009 227 4 86 (51) New stores Acquired leases Expanded or relocated stores Closed stores 240 - 75 (25) Of the 2.0 million selling square foot... -

Page 21

...ed our seasonal working capital requirements for existing stores and have funded our store opening and distribution network expansion programs from internally generated funds and borrowings under our credit facilities. The following table compares cash-ï¬,ow related information for the years ended... -

Page 22

... 30, 2010 and these amounts were accrued in the accompanying consolidated balance sheet as of January 30, 2010. We had no share repurchases in ï¬scal 2008. At January 29, 2011, we have approximately $345.9 million remaining under Board authorization. 20 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 23

Management's Discussion And Analysis Of Financial Condition And Results Of Operations Funding Requirements Overview We expect our cash needs for opening new stores and expanding existing stores in ï¬scal 2011 to total approximately $144.4 million, which includes capital expenditures, initial ... -

Page 24

... term loan outstanding under the Agreement and no amounts outstanding under the $300.0 million revolving line of credit. Revenue Bond Financing. In May 1998, we entered into an agreement with the Mississippi Business Finance Corporation under which it issued $19.0 million of variable-rate demand... -

Page 25

... apparent. Our management believes that our application of the retail inventory method results in an inventory valuation that reasonably approximates cost and results in carrying inventory at the lower of cost or market each year on a consistent basis. DOLLAR TREE, INC. ♦ 2010 Annual Report 23 -

Page 26

... amounts of inventory and hire a signiï¬cant number of temporary employees to supplement our continuing store staff. Our operating results, particularly operating and net income, could suffer if our net sales were below seasonal norms during the fourth quarter or during the Easter season for any... -

Page 27

... economic equivalent of a ï¬xed-rate obligation. We entered into two $75.0 million interest rate swap agreements in March 2008 to manage the risk associated with the interest rate ï¬,uctuations on a portion of our $250.0 million variable rate term loan. DOLLAR TREE, INC. ♦ 2010 Annual Report 25 -

Page 28

... rate swap agreement on an annual basis. Due to many factors, management is not able to predict the changes in the fair values of our interest rate swaps. These fair values are obtained from independent pricing services reï¬,ecting broker market quotes. Diesel Fuel Cost Risk In order to manage... -

Page 29

... the years in the three year period ended January 29, 2011, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Dollar Tree, Inc.'s internal control over ï¬nancial... -

Page 30

..., except per share data) Net sales Cost of sales, excluding non-cash beginning inventory adjustment Non-cash beginning inventory adjustment Gross proï¬t Selling, general and administrative expenses Operating income Interest expense, net Other income, net Income before income taxes Provision for... -

Page 31

... Balance Sheets (in millions, except share and per share data) ASSETS January 29, 2011 January 30, 2010 Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred tax assets Prepaid expenses and other current assets Total current assets Property, plant... -

Page 32

... of stock under Employee Stock Purchase Plan Exercise of stock options, including income tax beneï¬t of $2.0 Repurchase and retirement of shares Stock-based compensation, net, including income tax beneï¬t of $1.9 Balance at January 30, 2010 Net income for the year ended January 29, 2011 Other... -

Page 33

...-term debt and capital lease obligations Payments for share repurchases Proceeds from stock issued pursuant to stock-based compensation plans Tax beneï¬t of exercises/vesting of equity-based compensation Net cash provided by (used in) ï¬nancing activities Effect of exchange rate changes on cash... -

Page 34

... On May 26, 2010, the Company's Board of Directors approved a 3-for-2 stock split in the form of a 50% common stock dividend. New shares were distributed on June 24, 2010 to shareholders of record as of the close of business on June 10, 2010. As a result, all share and per share data in these... -

Page 35

...inventories. Costs directly associated with warehousing and distribution are capitalized as merchandise inventories. Total warehousing and distribution costs capitalized into inventory amounted to $30.8 million and $27.4 million at January 29, 2011 and January 30, 2010, respectively. Property, Plant... -

Page 36

... an asset or liability. As a basis for considering such assumptions, a fair value hierarchy has been established that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets 34 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 37

...Scholes option pricing model. The fair value of the RSUs is determined using the closing price of the Company's common stock on the date of grant. Net Income Per Share The Company expenses pre-opening costs for new, expanded and relocated stores, as incurred. Advertising Costs The Company expenses... -

Page 38

... long-term liabilities as of January 29, 2011 and January 30, 2010 consist of the following: (in millions) Deferred rent Insurance Other Total other long-term liabilities January 29, 2011 $ 73.0 39.9 10.6 $ 123.5 January 30, 2010 $ 69.3 38.5 12.4 $ 120.2 36 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 39

... 30, 2010 and January 31, 2009, are amounts related to changes in uncertain tax positions associated with temporary differences. A reconciliation of the statutory federal income tax rate and the effective rate follows: Year Ended January 29, 2011 Statutory tax rate Effect of: State and local income... -

Page 40

... Total deferred tax liabilities Net deferred tax asset January 29, 2011 $ 31.4 25.4 January 30, 2010 $ 23.0 24.8 4.3 6.7 22.2 2.0 83.0 (6.1) 76.9 - (15.1) (7.0) (13.6) (35.7) 41.2 - 6.4 22.5 1.9 87.6 (4.8) 82.8 (4.6) (15.8) (3.8) (4.3) (28.5) $ 54.3 $ 38 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 41

... rentals that may be paid under certain store leases based on a percentage of sales in excess of stipulated amounts. Future minimum lease payments have not been reduced by expected future minimum sublease rentals of $1.8 million under operating leases. DOLLAR TREE, INC. ♦ 2010 Annual Report 39 -

Page 42

... scheduled trial date. The Company will continue to vigorously defend itself in this matter. In 2007, two store managers ï¬led a class action against the Company in California federal court, claiming they and other California store managers should have been classiï¬ed as non-exempt employees under... -

Page 43

... hand down a decision in 2011. In 2010, two former assistant store managers ï¬led a collective action against the Company in a Florida federal court. Their amended claim is that they were required to work off the clock without compensation in violation of the Fair Labor Standards Act. An additional... -

Page 44

...rate of 2.8%. In exchange, the ï¬nancial institutions pay the Company at a variable rate, which equals the variable rate on the debt, excluding the NOTE 7-SHAREHOLDERS' EQUITY Preferred Stock credit spread. These swaps qualify for hedge accounting treatment and expire in March 2011. The fair value... -

Page 45

... a deï¬ned contribution proï¬t sharing and 401(k) plan which is available to all employees over 21 years of age who have completed one year of service in which they have worked at least 1,000 hours. Eligible employees may make elective salary deferrals. The Company may make contributions at its... -

Page 46

...divided by 33% of the price of a share of the Company's common stock. The exercise price will equal the fair market value of the Company's common stock at the date the option is issued. The options are fully vested when issued and have a term of 10 years. 44 DOLLAR TREE, INC. ♦ 2010 Annual Report -

Page 47

... The fair value of these RSUs was determined using the Company's closing stock price on the grant date. The following table summarizes the status of RSUs as of January 29, 2011, and changes during the year then ended: Weighted Average Grant Date Fair Shares Value Nonvested at January 30, 2010 1,445... -

Page 48

... Black-Scholes option pricing model for grants in 2008 are as follows. The 2010 and 2009 amounts are immaterial. Fiscal 2008 6.0 45.7% - 2.8% $8.97 837.440 Expected term in years Expected volatility Annual dividend yield Risk free interest rate Weighted average fair value of options granted during... -

Page 49

... the ESPP, the Company has sold 2,135,177 shares as of January 29, 2011. The fair value of the employees' purchase rights is estimated on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions: Fiscal Fiscal 2009 2008 Expected term 3 months... -

Page 50

... net income per share Stores open at end of quarter Comparable store net sales change Fiscal 2009: Net sales Gross proï¬t Operating income Net income Diluted net income per share Stores open at end of quarter Comparable store net sales change (1) Easter was observed on April 4, 2010 and April 12... -

Page 51

... directed to: Investor Relations Dollar Tree, Inc. 500 Volvo Parkway Chesapeake,VA 23320 (757) 321-5000 Or from the Investor Relations section of our Company web site: www.DollarTreeinfo.com Legal Counsel Williams Mullen 999 Waterside Drive Suite 1700 Norfolk,VA 23510 Independent Registered Public... -

Page 52

500 Volvo Parkway • Chesapeake, Virginia 23320 • Phone (757) 321-5000 www.DollarTree.com