Dollar Tree 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

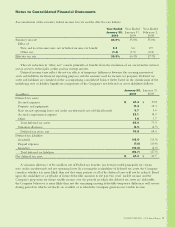

Notes to Consolidated Financial Statements

Stock Options

In2008and2007,theCompanygrantedatotalof0.5

millionand0.4millionservicebasedstockoptions

fromtheEIP,EOEPandtheNEDP,respectively.In

2009,theCompanygrantedlessthan0.1millionservice

based stock options from these plans. The fair value of

all of these options is being expensed ratably over the

three-year vesting periods, or a shorter period based

on the retirement eligibility of the grantee. All options

granted to directors vest immediately and are expensed

onthegrantdate.During2009,2008and2007,the

Companyrecognized$3.7million,$4.7millionand

$2.7million,respectivelyofexpenserelatedtoservice

basedstockoptiongrants.AsofJanuary30,2010,there

wasapproximately$3.3millionoftotalunrecognized

compensation expense related to these stock options

whichisexpectedtoberecognizedoveraweighted

average period of 15 months.

In2008,theCompanygranted0.1millionstock

optionsfromtheEIPandtheEOEPtocertainofcers

of the Company, contingent on the Company meeting

certainperformancetargetsin2008andfutureservice

oftheseofcersthroughscal2009.TheCompany

mettheseperformancetargetsinscal2008;therefore,

thefairvalueofthesestockoptionsof$1.0millionwas

expensed over the service period. The Company recog-

nized$0.5millionofexpenseonthesestockoptionsin

2009andin2008.Thefairvalueofthesestockoptions

wasdeterminedusingtheCompany’sclosingstock

price on the grant date.

The fair value of each option grant was estimated

on the date of grant using the Black-Scholes option-

pricing model. The expected term of the awards

grantedwascalculatedusingthe“simpliedmethod”in

accordancewithStaffAccountingBulletinNo.107.

Expected volatility is derived from an analysis of the

historicalandimpliedvolatilityoftheCompany’s

publicly traded stock. The risk free rate is based on the

U.S. Treasury rates on the grant date with maturity

dates approximating the expected life of the option on

the grant date. The weighted average assumptions used

in the Black-Scholes option pricing model for grants in

2009,2008and2007areasfollows:

Fiscal

2009

Fiscal

2008

Fiscal

2007

Expected term in years 6.0 6.0 6.0

Expected volatility 43.6% 45.7% 28.4%

Annual dividend yield — — —

Risk free interest rate 2.0% 2.8% 4.5%

Weightedaveragefairvalue

of options granted during

the period $20.76 $13.45 $14.33

Options granted 15,939 558,293 386,490

DOLLARTREE,INC.•2009AnnualReport45