Dollar Tree 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

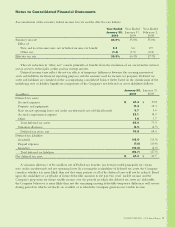

Notes to Consolidated Financial Statements

Unsecured Credit Agreement

OnFebruary20,2008,theCompanyenteredinto

theAgreementwhichprovidesfora$300.0million

revolvinglineofcredit,includingupto$150.0million

inavailablelettersofcredit,anda$250.0millionterm

loan. The interest rate on the facility is based, at the

Company’soption,onaLIBORrate,plusamargin,

or an alternate base rate, plus a margin. The revolving

line of credit also bears a facilities fee, calculated as a

percentage,asdened,oftheamountavailableunder

the line of credit, payable quarterly. The term loan

isdueandpayableinfullattheveyearmaturity

date of the Agreement. The Agreement also bears an

administrative fee payable annually. The Agreement,

among other things, requires the maintenance of

certainspeciednancialratios,restrictsthepayment

of certain distributions and prohibits the incurrence of

certainnewindebtedness.AsofJanuary30,2010,we

hadthe$250.0milliontermloanoutstandingunder

the Agreement and no amounts outstanding under the

$300.0millionrevolvinglineofcredit.

Demand Revenue Bonds

OnMay20,1998,theCompanyenteredintoanunse-

cured Loan Agreement with the Mississippi Business

Finance Corporation (MBFC) under which the MBFC

issuedTaxableVariableRateDemandRevenueBonds

(theBonds)inanaggregateprincipalamountof$19.0

milliontonancetheacquisition,construction,and

installation of land, buildings, machinery and equip-

mentfortheCompany’sdistributionfacilityinOlive

Branch, Mississippi. The Bonds do not contain a

prepayment penalty as long as the interest rate remains

variable. The Bonds contain a demand provision and,

therefore,areclassiedascurrentliabilities.

NOTE 6—DERIVATIVE FINANCIAL

INSTRUMENTS

Hedging Derivatives

OnMarch20,2008,theCompanyenteredintotwo

$75.0millioninterestrateswapagreements.These

interest rate swaps are used to manage the risk associ-

ated with interest rate fluctuations on a portion of the

Company’svariableratedebt.Undertheseagreements,

theCompanypaysinteresttonancialinstitutions

ataxedrateof2.8%.Inexchange,thenancial

institutions pay the Company at a variable rate, which

equals the variable rate on the debt, excluding the

credit spread. These swaps qualify for hedge accounting

treatmentandexpireinMarch2011.Thefairvalueof

theseswapsasofJanuary30,2010wasaliabilityof$4.1

million.

Inordertomanageuctuationsincashows

resulting from changes in diesel fuel costs, we entered

into fuel derivative contracts with a third party in

thefourthquarterof2009for2.4milliongallonsof

dieselfuel,orapproximately25%ofourfuelneeds

fromMay2010throughJanuary2011.Underthese

contracts,wepaythethirdpartyaxedpricefordiesel

fuel and receive variable diesel fuel prices at amounts

approximating current diesel fuel costs, thereby creating

theeconomicequivalentofaxed-rateobligation.

These derivative contracts do not qualify for hedge

accounting and therefore all changes in fair value for

these derivatives will be included directly into earnings.

ThefairvalueofthesecontractsatJanuary30,2010was

aliabilityof$0.2million.

DOLLARTREE,INC.•2009AnnualReport41