Dollar Tree 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

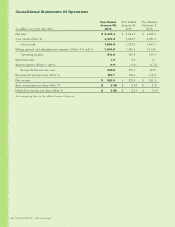

Management’s Discussion And Analysis Of Financial Condition

And Results Of Operations

ourfuelneedsfromMay2010throughJanuary2011.

These derivative contracts do not qualify for hedge

accounting and therefore all changes in fair value for

these derivatives will be included directly in earnings.

Critical Accounting Policies

Thepreparationofnancialstatementsrequiresthe

use of estimates. Certain of our estimates require

ahighlevelofjudgmentandhavethepotentialto

haveamaterialeffectonthenancialstatementsif

actualresultsvarysignicantlyfromthoseestimates.

Following is a discussion of the estimates that we

consider critical.

Inventory Valuation

As discussed in Note 1 to the Consolidated Financial

Statements, inventories at the distribution centers are

stated at the lower of cost or market with cost deter-

mined on a weighted-average basis. Cost is assigned to

store inventories using the retail inventory method on

a weighted-average basis. Under the retail inventory

method, the valuation of inventories at cost and the

resulting gross margins are computed by applying

a calculated cost-to-retail ratio to the retail value of

inventories.Sinceourinceptionthroughscal2009,

we have used one inventory pool for this calcula-

tion. Over the years, we have invested in our retail

technologysystems,whichhasallowedustoreneour

estimate of inventory cost under the retail method.

OnJanuary,31,2010,therstdayofscal2010,we

beganusingapproximately30inventorypoolsinour

retail inventory calculation. As a result of this change,

weexpecttorecordanon-cashchargetogrossprot

and a corresponding reduction in inventory, at cost, of

approximately$26millionintherstquarterof2010.

The retail inventory method is an averaging method

that has been widely used in the retail industry and

results in valuing inventories at lower of cost or market

when markdowns are taken as a reduction of the retail

value of inventories on a timely basis.

Inventoryvaluationmethodsrequirecertain

signicantmanagementestimatesandjudgments,

including estimates of future merchandise markdowns

andshrink,whichsignicantlyaffecttheending

inventory valuation at cost as well as the resulting gross

margins. The averaging required in applying the retail

Interest on Long-term Borrowings. This amount

represents interest payments on the Credit Agreement

andtherevenuebondnancingusingtheinterestrates

foreachatJanuary30,2010.

Commitments

Letters of Credit and Surety Bonds.In

March2001,weenteredintoaLetterofCredit

Reimbursement and Security Agreement, which

provides$121.5millionforlettersofcredit.In

December2004,weenteredintoanadditionalLetterof

Credit Reimbursement and Security Agreement, which

provides$50.0millionforlettersofcredit.Lettersof

credit are generally issued for the routine purchase of

importedmerchandiseandwehadapproximately$101.8

million of purchases committed under these letters of

creditatJanuary30,2010.

Wealsohaveapproximately$17.4millionof

letters of credit or surety bonds outstanding for our

self-insurance programs and certain utility payment

obligations at some of our stores.

Freight Contracts.Wehavecontractedoutbound

freight services from various carriers with contracts

expiringthroughscal2013.Thetotalamountofthese

commitmentsisapproximately$296.2million.

Technology Assets.Wehavecommitmentstotaling

approximately$2.4milliontoprimarilypurchasestore

technologyassetsforourstoresduring2010.

Derivative Financial Instruments

OnMarch20,2008,weenteredintotwo$75.0million

interest rate swap agreements. These interest rate swaps

are used to manage the risk associated with interest rate

uctuationsonaportionofour$250.0millionvariable

rate term loan. Under these agreements, we pay interest

tonancialinstitutionsataxedrateof2.8%.In

exchange,thenancialinstitutionspayusatavariable

rate, which approximates the variable rate on the debt,

excluding the credit spread. These swaps qualify for

hedgeaccountingtreatmentandexpireinMarch2011.

Inthefourthquarterof2009,weenteredinto

fuel derivative contracts with a third party. As a result

ofthesecontracts,wehavexedthefuelpriceon2.4

milliongallonsofdieselfuel,orapproximately25%of

22DOLLARTREE,INC.•2009AnnualReport