Dollar Tree 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

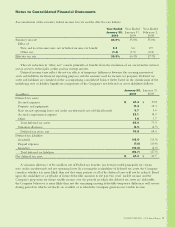

Notes to Consolidated Financial Statements

lives of the respective assets or the committed terms of

therelatedleases,whicheverisshorter.Amortization

is included in “selling, general and administrative

expenses” in the accompanying consolidated statements

of operations.

Costs incurred related to software developed for

internalusearecapitalizedandamortizedgenerallyover

three years.

Goodwill

Goodwillisnotamortized,butrathertestedforimpair-

mentatleastannually.Inaddition,goodwillwillbe

tested on an interim basis if an event or circumstance

indicates that it is more likely than not that an impair-

ment loss has been incurred. The Company performed

itsannualimpairmenttestinginNovember2009and

determined that no impairment loss existed.

Other Assets, Net

Other assets, net consists primarily of restricted invest-

ments and intangible assets. Restricted investments

were$78.4millionand$58.5millionatJanuary30,

2010andJanuary31,2009,respectivelyandwere

purchasedtocollateralizelong-terminsurance

obligations. These investments consist primarily of

government-sponsored municipal bonds, similar to the

Company’sshort-terminvestmentsandmoneymarket

securities.Theseinvestmentsareclassiedasavailable

for sale and are recorded at fair value, which approxi-

matescost.Intangibleassetsprimarilyincludefavorable

leaserightswithniteusefullivesandareamortized

over their respective estimated useful lives.

Impairment of Long-Lived Assets and

Long-Lived Assets to Be Disposed Of

The Company reviews its long-lived assets and certain

identiableintangibleassetsforimpairmentwhenever

events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable.

Recoverability of assets to be held and used is measured

by comparing the carrying amount of an asset to

future net undiscounted cash flows expected to be

generatedbytheasset.Ifsuchassetsareconsidered

tobeimpaired,theimpairmenttoberecognizedis

measured as the amount by which the carrying amount

of the assets exceeds the fair value of the assets based

on discounted cash flows or other readily available

evidence of fair value, if any. Assets to be disposed of

are reported at the lower of the carrying amount or fair

valuelesscoststosell.Inscal2009,2008and2007,the

Companyrecordedchargesof$1.3million,$1.2million

and$0.8million,respectively,towritedowncertain

assets. These charges are recorded as a component of

“selling, general and administrative expenses” in the

accompanying consolidated statements of operations.

Financial Instruments

TheCompanyutilizesderivativenancialinstruments

to reduce its exposure to market risks from changes

in interest rates and diesel fuel costs. By entering into

receive-variable,pay-xedinterestrateanddieselfuel

swaps, the Company limits its exposure to changes

in variable interest rates and diesel fuel prices. The

Company is exposed to credit-related losses in the

event of non-performance by the counterparty to these

instruments. However, these swaps are in a net liability

positionasofJanuary30,2010,thereforenocreditrisk

existsasofthatdate.Interestrateordieselfuelcost

differentials paid or received on the swaps are recog-

nizedasadjustmentstointerestandfreightexpense,

respectively, in the period earned or incurred. The

Company formally documents all hedging relationships,

if applicable, and assesses hedge effectiveness both at

inception and on an ongoing basis. The interest rate

swaps that qualify for hedge accounting are recorded

at fair value in the accompanying consolidated balance

sheetsasacomponentof“otherliabilities”(seeNote6).

Changes in the fair value of these interest rate swaps

are recorded in “accumulated other comprehensive loss”,

net of tax, in the accompanying consolidated balance

sheets. The Company entered into diesel fuel swaps in

thefourthquarterof2009thatdonotqualifyforhedge

accounting. The fair value of this interest rate swap is

recorded in the accompanying consolidated balance

sheetsasacomponentof“otherliabilities”(seeNote6).

Fair Value Measurements

InFebruary2008,theFinancialAccountingStandards

Board (FASB) released new guidance which delayed

theeffectivedatetovalueallnon-nancialassetsand

non-nancialliabilities,exceptthosethatarerecognized

or disclosed at fair value on a recurring basis (at least

annually)untiltherstquarterof2009.Theadoption

ofthenewguidancedidnothaveasignicantimpact

on the Consolidated Financial Statements.

Fairvalueisdenedasanexitprice,representing

the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction

DOLLARTREE,INC.•2009AnnualReport33