Dollar Tree 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pre-Opening Costs

The Company expenses pre-opening costs for new,

expanded and relocated stores, as incurred.

Advertising Costs

The Company expenses advertising costs as they are

incurred and they are included in “selling, general

and administrative expenses” on the accompanying

consolidated statements of operations. Advertising

costsapproximated$8.3million,$6.6millionand$8.4

millionfortheyearsendedJanuary30,2010,January31,

2009,andFebruary2,2008,respectively.

Income Taxes

Incometaxesareaccountedforundertheassetand

liabilitymethod.Deferredtaxassetsandliabilitiesare

recognizedforthefuturetaxconsequencesattributable

todifferencesbetweennancialstatementcarrying

amounts of existing assets and liabilities and their

respectivetaxbases.Deferredtaxassetsandliabilities

are measured using enacted tax rates expected to

apply to taxable income in the years in which those

temporary differences are expected to be recovered or

settled. The effect on deferred tax assets and liabilities

ofachangeintaxratesisrecognizedinincomeinthe

period that includes the enactment date of such change.

The Company includes interest and penalties in

the provision for income tax expense and income

taxes payable. The Company does not provide for any

penalties associated with tax contingencies unless they

are considered probable of assessment.

Stock-Based Compensation

TheCompanyrecognizesallshare-basedpaymentsto

employees, including grants of employee stock options,

inthenancialstatementsbasedontheirfairvalues.

Totalstock-basedcompensationexpensefor2009,2008

and2007was$21.7million,$16.7millionand$11.3

million, respectively.

TheCompanyrecognizesexpenserelatedtothefair

value of stock options and restricted stock units (RSUs)

over the requisite service period on a straight-line basis.

The fair value of stock option grants is estimated on the

date of grant using the Black-Scholes option pricing

model. The fair value of the RSUs is determined using

theclosingpriceoftheCompany’scommonstockon

the date of grant.

Net Income Per Share

Basic net income per share has been computed by

dividing net income by the weighted average number

ofsharesoutstanding.Dilutednetincomepershare

reflects the potential dilution that could occur assuming

the inclusion of dilutive potential shares and has been

computed by dividing net income by the weighted

average number of shares and dilutive potential shares

outstanding.Dilutivepotentialsharesincludeall

outstanding stock options and unvested restricted stock

after applying the treasury stock method.

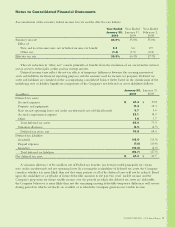

NOTE 2—BALANCE SHEET COMPONENTS

Property, Plant and Equipment, Net

Property,plantandequipment,net,asofJanuary30,

2010andJanuary31,2009consistsofthefollowing:

(in millions)

January 30,

2010

January31,

2009

Land $ 29.4 $ 29.4

Buildings 180.2 181.9

Leasehold improvements 634.2 590.9

Furniture,xturesand

equipment 895.5 856.0

Construction in progress 55.5 22.4

To tal property, plant and

equipment 1,794.8 1,680.6

Less: accumulated

depreciation 1,080.5 970.3

To tal property, plant and

equipment, net $ 714.3 $ 710.3

Depreciationexpensewas$157.8million,$161.1

millionand$158.5millionfortheyearsended

January30,2010,January31,2009,andFebruary2,

2008,respectively.

DOLLARTREE,INC.•2009AnnualReport35