Dollar Tree 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

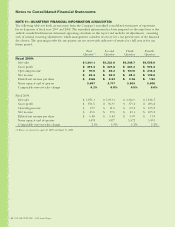

Share Repurchase Programs

TheCompanyrepurchasedapproximately4.3million

sharesforapproximately$193.1millioninscal2009.

Lessthan0.1millionsharestotaling$2.4millionhad

notsettledasofJanuary30,2010andtheseamounts

have been accrued in the accompanying consolidated

balancesheetsasofJanuary30,2010.TheCompany

repurchasedapproximately12.8millionsharesfor

approximately$473.0millioninscal2007.The

Companyhadnosharerepurchasesinscal2008.At

January30,2010,theCompanyhadapproximately

$260.6millionremainingunderBoardauthorization.

OnMarch29,2007,theCompanyenteredinto

anagreementwithathirdpartytorepurchase$150.0

millionoftheCompany’scommonsharesunderan

Accelerated Share Repurchase Agreement. The entire

$150.0millionwasexecutedundera“collared”agree-

ment. Under this agreement, the Company initially

received3.6millionsharesthroughApril12,2007,

representing the minimum number of shares to be

received based on a calculation using the “cap” or high-

end of the price range of the collar. The maximum

number of shares that could have been received under

theagreementwas4.1million.Thenumberofshares

was determined based on the weighted average market

priceoftheCompany’scommonstockduringthefour

months after the initial execution date. The calculated

weightedaveragemarketpricethroughJuly30,2007,

NOTE 7—SHAREHOLDERS’ EQUITY

Preferred Stock

TheCompanyisauthorizedtoissue10,000,000sharesofPreferredStock,$0.01parvaluepershare.Nopreferredshares

areissuedandoutstandingatJanuary30,2010andJanuary31,2009.

Net Income Per Share

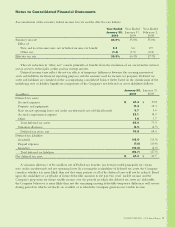

The following table sets forth the calculation of basic and diluted net income per share:

(in millions, except per share data)

Year Ended

January 30,

2010

YearEnded

January31,

2009

YearEnded

February2,

2008

Basic net income per share:

Net income $ 320.5 $ 229.5 $ 201.3

Weightedaveragenumberofsharesoutstanding 89.4 90.3 95.9

Basic net income per share $ 3.59 $ 2.54 $ 2.10

Dilutednetincomepershare:

Net income $ 320.5 $ 229.5 $ 201.3

Weightedaveragenumberofsharesoutstanding 89.4 90.3 95.9

Dilutiveeffectofstockoptionsandrestrictedstock

(as determined by applying the treasury stock method) 0.6 0.5 0.5

Weightedaveragenumberofsharesanddilutivepotential

shares outstanding 90.0 90.8 96.4

Dilutednetincomepershare $ 3.56 $ 2.53 $ 2.09

AtJanuary30,2010,lessthan0.1millionstockoptionsarenotincludedinthecalculationoftheweighted

average number of shares and dilutive potential shares outstanding because their effect would be anti-dilutive.

AtJanuary31,2009andFebruary2,2008,0.5million,and0.4millionstockoptions,respectivelyarenotincluded

in the calculation of the weighted average number of shares and dilutive potential shares outstanding because their

effect would be anti-dilutive.

42DOLLARTREE,INC.•2009AnnualReport