Dollar Tree 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

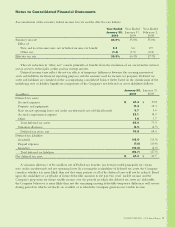

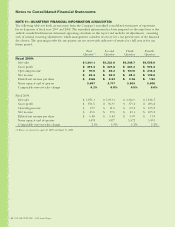

Notes to Consolidated Financial Statements

NOTE 9—STOCK-BASED COMPENSATION

PLANS

AtJanuary30,2010,theCompanyhaseightstock-based

compensation plans. Each plan and the accounting

method are described below.

Fixed Stock Option Compensation Plans

UndertheNon-QualiedStockOptionPlan(SOP),

the Company granted options to its employees for

1,047,264sharesofCommonStockin1993and

1,048,289sharesin1994.Optionsgrantedunderthe

SOPhaveanexercisepriceof$0.86andarefullyvested

at the date of grant.

Underthe1995StockIncentivePlan(SIP),the

Company granted options to its employees for the

purchaseofupto12.6millionsharesofCommon

Stock. The exercise price of each option equaled the

marketpriceoftheCompany’sstockatthedateof

grant, unless a higher price was established by the

BoardofDirectors,andanoption’smaximumtermis10

years.OptionsgrantedundertheSIPgenerallyvested

over a three-year period. This plan was terminated on

July1,2003andreplacedwiththeCompany’s2003

EquityIncentivePlan(EIP).

UndertheEIP,theCompanymaygrantupto

6.0millionsharesofitsCommonStock,plusany

sharesavailableforfutureawardsundertheSIP,tothe

Company’semployees,includingexecutiveofcers

andindependentcontractors.TheEIPpermitsthe

Company to grant equity awards in the form of stock

options, stock appreciation rights and restricted stock.

The exercise price of each stock option granted equals

themarketpriceoftheCompany’sstockatthedate

of grant. The options generally vest over a three-year

periodandhaveamaximumtermof10years.

TheExecutiveOfcerEquityIncentivePlan

(EOEP)isavailableonlytotheChiefExecutiveOfcer

andcertainotherexecutiveofcers.Theseofcersno

longerreceiveawardsundertheEIP.TheEOEPallows

the Company to grant the same type of equity awards

asdoestheEIP.Theseawardsgenerallyvestovera

three-yearperiod,withamaximumtermof10years.

Stock appreciation rights may be awarded alone

orintandemwithstockoptions.Whenthestock

appreciation rights are exercisable, the holder may

surrender all or a portion of the unexercised stock

appreciation right and receive in exchange an amount

equal to the excess of the fair market value at the date

of exercise over the fair market value at the date of the

grant. No stock appreciation rights have been granted

to date.

AnyrestrictedstockorRSUsawardedaresubject

to certain general restrictions. The restricted stock

shares or units may not be sold, transferred, pledged or

disposed of until the restrictions on the shares or units

have lapsed or have been removed under the provisions

oftheplan.Inaddition,ifaholderofrestrictedshares

or units ceases to be employed by the Company, any

shares or units in which the restrictions have not lapsed

will be forfeited.

The2003Non-EmployeeDirectorStockOption

Plan(NEDP)providesnon-qualiedstockoptionsto

non-employeemembersoftheCompany’sBoardof

Directors.Thestockoptionsarefunctionallyequivalent

tosuchoptionsissuedundertheEIPdiscussedabove.

The exercise price of each stock option granted equals

themarketpriceoftheCompany’sstockatthedateof

grant. The options generally vest immediately.

The2003DirectorDeferredCompensationPlan

permitsanyoftheCompany’sdirectorswhoreceive

a retainer or other fees for Board or Board committee

service to defer all or a portion of such fees until a

future date, at which time they may be paid in cash or

sharesoftheCompany’scommonstock,orreceiveall

or a portion of such fees in non-statutory stock options.

Deferredfeesthatarepaidoutincashwillearninterest

atthe30-yearTreasuryBondRate.Ifadirectorelects

to be paid in common stock, the number of shares will

be determined by dividing the deferred fee amount by

thecurrentmarketpriceofashareoftheCompany’s

common stock on the date of deferral. The number

of options issued to a director will equal the deferred

feeamountdividedby33%ofthepriceofashareof

theCompany’scommonstock.Theexercisepricewill

equalthefairmarketvalueoftheCompany’scommon

stock at the date the option is issued. The options are

fullyvestedwhenissuedandhaveatermof10years.

44DOLLARTREE,INC.•2009AnnualReport