Dollar Tree 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

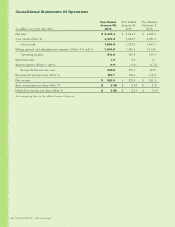

A reconciliation of the statutory federal income tax rate and the effective rate follows:

Year Ended

January 30,

2010

YearEnded

January31,

2009

YearEnded

February2,

2008

Statutory tax rate 35.0% 35.0% 35.0%

Effect of:

Stateandlocalincometaxes,netoffederalincometaxbenet 3.3 3.0 2.9

Other, net (1.4) (1.9) (0.8)

Effective tax rate 36.9% 36.1% 37.1%

Theratereductionin“other,net”consistsprimarilyofbenetsfromtheresolutionoftaxuncertainties,interest

ontaxreserves,federaljobscreditsandtaxexemptinterest.

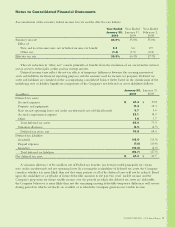

Deferredincometaxesreectthenettaxeffectsoftemporarydifferencesbetweenthecarryingamountsof

assetsandliabilitiesfornancialreportingpurposesandtheamountsusedforincometaxpurposes.Deferredtax

assetsandliabilitiesareclassiedontheaccompanyingconsolidatedbalancesheetsbasedontheclassicationofthe

underlyingassetorliability.SignicantcomponentsoftheCompany’snetdeferredtaxassets(liabilities)follows:

(in millions)

January 30,

2010

January31,

2009

Deferredtaxassets:

Accrued expenses

$ 41.3

$ 39.2

Property and equipment 11.3 12.3

Statetaxnetoperatinglossesandcreditcarryforwards,netoffederalbenet 6.7 5.4

Accrued compensation expense 22.1 14.9

Other 1.6 1.7

Total deferred tax assets 83.0 73.5

Valuation allowance (6.1) (4.9)

Deferredtaxassets,net 76.9 68.6

Deferredtaxliabilities:

Goodwill (15.1) (13.5)

Prepaid expenses (7.0) (10.4)

Inventory (13.6) (4.0)

Total deferred tax liabilities (35.7) ( 27.9 )

Net deferred tax asset

$ 41.2

$ 40.7

Avaluationallowanceof$6.1million,netofFederaltaxbenets,hasbeenprovidedprincipallyforcertain

statecreditcarryforwardsandnetoperatinglosses.Inassessingtherealizabilityofdeferredtaxassets,theCompany

considerswhetheritismorelikelythannotthatsomeportionorallofthedeferredtaxeswillnotberealized.Based

upontheavailabilityofcarrybacksoffuturedeductibleamountstothepasttwoyears’taxableincomeandthe

Company’sprojectionsforfuturetaxableincomeovertheperiodsinwhichthedeferredtaxassetsaredeductible,

the Company believes it is more likely than not the remaining existing deductible temporary differences will reverse

during periods in which carrybacks are available or in which the Company generates net taxable income.

DOLLARTREE,INC.•2009AnnualReport37