BT 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 BT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REVIEW OF THE YEAR OUR BUSINESS AND STRATEGY

14 BT GROUP PLC ANNUAL REPORT & FORM 20-F

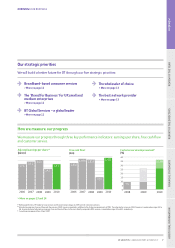

Customer service

In 2010 we achieved a 10.5% increase in the internal scores we use

to measure customer service. This compares with a 9%

improvement in 2008 and 17% in 2009. These measures are

cumulative, so the results show real progress is being made.

2010 outlook

In our original outlook statement for 2010 we said we expected:

revenue to decline by 4%-5%

a net reduction in group capital expenditure and operating costs

of well over £1bn

a reduction in group capital expenditure to around £2.7bn

group free cash flow, before any pension deficit payments, but

after the cash costs of BT Global Services restructuring, to reach

over £1bn.

During the year, as a result of our progress, we were able to update

our outlook to:

revenue to decline by 3%-4%

total underlying cost reductions of at least £1.5bn

EBITDA of around £5.7bn

capital expenditure of around £2.5bn

free cash flow of around £1.7bn

net debt below £10bn

dividend growth of around 5%.

As shown in the Financial summary on page 3 we have delivered

full year results ahead of our outlook.

2011 outlook and future plans

We aim to drive shareholder value by making BT a better business

by focusing on three areas: customer service delivery; cost

transformation; and investing for the future. We will build a better

business for the future by focusing on five strategic priorities:

driving broadband-based consumer services; being the ‘Brand for

Business’ for UK SMEs; developing BT Global Services’ position as a

global leader in networked IT services; being the wholesaler of

choice; and being the best network provider.

As part of our plans for the future, we are making an additional

investment of around £200m within our adjusted EBITDA outlook

for 2011: mainly in the areas of enhancing our TV offering;

introducing other new consumer propositions; fibre roll out; and

Customer service year-on-year improvement

(%)

2008 2009 2010

0

5

10

15

20

25

30

35

40

9%

17%

10.5%

building on opportunities in BT Global Services, particularly in the

Asia Pacific region.

If investment conditions are favourable, we see the potential to

extend our current fibre roll out to around two-thirds of UK

premises by 2015 for an incremental cost of around £1bn, while

maintaining our annual capital expenditure levels at around

£2.6bn.

For 2011 our outlook is:

revenue of around £20bn

operating cost savingsaof around £900m

adjusted EBITDAbafter leaver costs in line with last year’s level

with underlying improvement being offset by the increase in the

pension service charge of around £100m and targeted

investment in the business of around £200m

free cash flowcof around £1.8bn before the cash effect of

specific items of around £150m, with capital expenditure at

around £2.6bn

BT Global Services operating cash flow expected to show further

significant improvement, turning positive by 2012

Net debt below £9bn.

Our future outlook is as follows:

we expect improving underlying revenue trends from 2011 to

2013, with growth in 2013

BT Global Services revenue expected to grow by 2013

BT Retail expected to show an improvement in revenue trends

over the period to 2013

BT Wholesale and Openreach revenue expected to be broadly

level over the period to 2013

adjusted EBITDAbafter leaver costs expected to grow from 2011

to 2013 driven by a combination of further cost reductions and

improving revenue trends

free cash flowcbefore specific items expected to reach around

£2bn by 2013

progressive dividends over the next three years.

aUnderlying operating costs before specific items, depreciation and amortisation.

bBefore specific items.

cBefore pension deficit payment.