Airtran 2008 Annual Report Download - page 97

Download and view the complete annual report

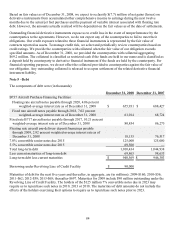

Please find page 97 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have variable interests in our aircraft leases. The lessors are trusts established specifically to purchase,

finance and lease aircraft to us. These leasing entities meet the criteria of variable interest entities, as defined by

FASB Interpretation 46R, Consolidation of Variable Interest Entities. We are generally not the primary

beneficiary of the leasing entities if the lease terms are consistent with market terms at the inception of the lease

and do not include a residual value guarantee, a fixed-price purchase option or similar feature that obligates us

to absorb decreases in value or entitles us to participate in increases in the value of the aircraft. This is the case

in the majority of our aircraft leases; however, we have two aircraft leases that contain fixed-price purchase

options that allow us to purchase the aircraft at predetermined prices on specified dates during the lease term.

We have not consolidated the related trusts because, even taking into consideration these purchase options, we

are not the primary beneficiary based on our cash flow analysis. Our maximum exposure under the two leases is

limited to the remaining lease payments, which are reflected in the future minimum lease payments in the table

above.

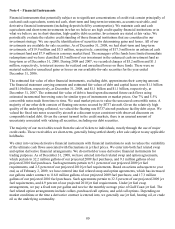

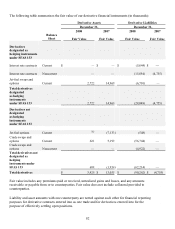

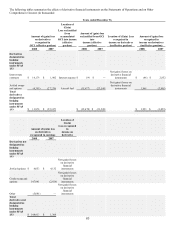

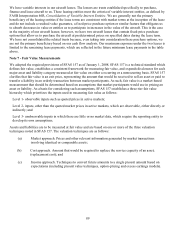

Note 7 - Fair Value Measurements

We adopted the required provisions of SFAS 157 as of January 1, 2008. SFAS 157 is a technical standard which

defines fair value, establishes a consistent framework for measuring fair value, and expands disclosures for each

major asset and liability category measured at fair value on either a recurring or a nonrecurring basis. SFAS 157

clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based

measurement that should be determined based on assumptions that market participants would use in pricing an

asset or liability. As a basis for considering such assumptions, SFAS 157 establishes a three-tier fair value

hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1- observable inputs such as quoted prices in active markets;

Level 2- inputs, other than the quoted market prices in active markets, which are observable, either directly or

indirectly; and

Level 3- unobservable inputs in which there are little or no market data, which require the reporting entity to

develop its own assumptions.

Assets and liabilities are to be measured at fair value and are based on one or more of the three valuation

techniques noted in SFAS 157. The valuation techniques are as follows:

(a) Market approach. Prices and other relevant information generated by market transactions

involving identical or comparable assets;

(b) Cost approach. Amount that would be required to replace the service capacity of an asset;

(replacement cost); and

(c) Income approach. Techniques to convert future amounts to a single present amount based on

expectations (including present value techniques, option-pricing and excess earnings models).

89