Airtran 2008 Annual Report Download - page 89

Download and view the complete annual report

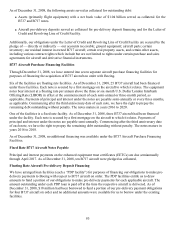

Please find page 89 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fuel related derivative financial instruments are accounted for as cash flow hedges under SFAS 133 when the

required accounting documentation is in place and the derivative arrangement has been analytically

demonstrated to be effective. The ineffective portion of changes in the fair value of each such derivative is

recognized currently in other (income) expense, and the effective portion of the change in the fair value is

recorded as a component of other comprehensive income (loss). The effective portion is reclassified to earnings

during the period in which the hedged transaction affects earnings. Realized and unrealized gains and losses on

derivatives that do not qualify for hedge accounting are recognized currently in other (income) expense. Sold

calls and derivatives using crude oil as the underlying commodity did not qualify for hedge accounting. In 2008,

we recognized non-operating losses related to derivatives that did not qualify for hedge accounting and

ineffectiveness on derivatives that qualified for hedge accounting of $150.8 million. During 2008, we realized

losses of $126.3 million (including $109 million to unwind certain derivative financial instruments pertaining to

2009 fuel requirements). Realized losses include $41.2 million that settled in cash in early 2009. In 2007, we

recognized non-operating gains on fuel related derivatives that did not qualify for hedge accounting and

ineffectiveness on fuel related derivatives that qualified for hedge accounting of $2.6 million.

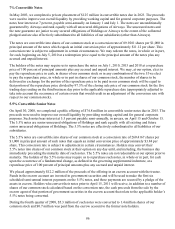

Historically, a majority of our fuel related derivative financial instruments did not qualify to be accounted for as

hedges. Consequently, a majority of the gains and losses on our fuel related derivative financial instruments

have been classified as other (income) expense based on estimated changes in fair value and the gains and

losses on other fuel related derivative financial instruments have been classified as a component of fuel expense

when realized. In order to simplify the financial reporting for fuel related derivatives, effective January 1, 2009,

we ceased designating all fuel related derivative financial instruments as accounting hedges. Fuel related

derivative financial instruments outstanding as of December 31, 2008 previously designated as accounting

hedges will continue to be accounted for as hedges.

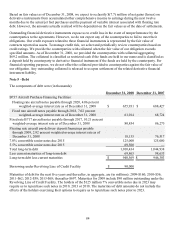

We have interest rate swap agreements that effectively convert a portion of our floating-rate debt to a fixed-rate

basis for the remaining life of the loan, thus reducing the impact of interest-rate changes on future interest

expense and cash flows. Under these agreements, which expire in 2018 and 2019, we pay fixed rates between

4.560 percent and 5.085 percent and receive the three-month USD London Interbank Offered Rate (LIBOR) on

the notional values. The notional amount of outstanding debt related to the interest rate swaps as of December

31, 2008 was $177.7 million. The primary objective for our use of interest rate swaps is to reduce the impact on

our operating results of the volatility of interest rates. These interest rate swap arrangements are accounted for

as cash flow hedges. The ineffective portion of the change in fair value of each derivative is recognized in other

(income) expense, and the effective portion of the change in fair value is recorded as a component of other

comprehensive income (loss). The effective portion is reclassified to interest expense during the period in which

the hedged transaction affects earnings.

81