Airtran 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our repayment obligations with respect to the letter of credit and revolving line of credit facility are

collateralized by certain of our assets. As of December 31, 2008, $90 million of the line of credit had been

drawn by us and our unrestricted cash and short-term investments aggregated $335.0 million ($340.5 million

including long-term investments).

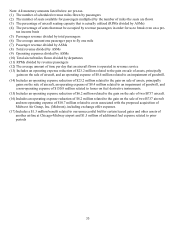

Mitigate Our Fuel Exposure. We continued to seek to mitigate our fuel cost exposure by entering into a variety

of hedging arrangements that provide partial protection against price increases. For every dollar increase per

barrel in crude oil or refining costs, our fuel expense for 2009, before the impact of our derivative financial

instruments, would increase approximately $9.0 million, based on our projected level of operations. We hedge

our fuel cost exposure with a portfolio of swaps and various types of options using both crude oil and jet fuel as

the underlying commodity. However, our portfolio contains a variety of compound financial instruments

including sold calls, which tend to limit the cash benefit of our hedges if jet fuel and crude oil prices increase

beyond the call strike prices. One effect of the recent decreases in the prices of crude oil and jet fuel has been

the need for us to post significant cash collateral related to certain of our fuel related derivative agreements. As

of December 31, 2008, we had provided counterparties with collateral aggregating $69.2 million, which

represented approximately 80 percent of the aggregate fair value of our fuel related derivative financial

instrument obligations and our interest rate swap arrangements. Also, in response to the decline in fuel prices,

we have elected to unwind certain of our other derivative agreements. During the fourth quarter of 2008, we

realized losses of $109 million (of which $41.2 million was paid in early January 2009) to unwind certain

derivative financial arrangements pertaining to 2009 fuel requirements which decreased the gallons under

hedges to approximately 9.1 percent of our expected 2009 fuel requirements, which will continue to provide

partial protection against price increases. Since September 30, 2008, we have revised the composition of our

portfolio of fuel related derivative financial instruments in part to reduce our obligation to provide collateral to

counterparties in the event of a decrease in the price of the underlying commodity. More specifically, as of

February 2, 2009, our portfolio contained relatively fewer collars and relatively more purchased calls.

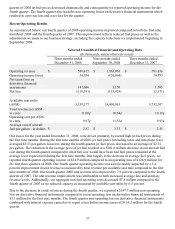

Increase Revenues. We implemented a number of fare increases beginning in September 2007, which partially

mitigated the impact of record high fuel prices during the first nine months of 2008. In addition to increasing

fares, we also increased surcharge and ancillary revenues. We implemented fuel surcharges and introduced fees

for advance and priority seat selection, call center utilization, checked baggage and the purchase, extension or

transfer A+ Rewards. As a result, our total revenue per available seat mile metrics for the fourth quarter of

2008, and for 2008 as a whole, were record highs.

Provide Quality Low Fare Service. Despite the need to make adjustments to our business strategy in 2008, our

strategy continues to place strong emphasis on providing superior and friendly service. While third party

assessments for 2008 are not yet available, in April 2008, AirTran Airways was rated first in the highly

regarded annual Airline Quality Rating (AQR) study, developed in 1991 as an objective method for assessing

airline quality. AirTran Airways, ranked second the prior year, was one of only four airlines to improve its AQR

score between 2006 and 2007. Our most recent Airline Quality Rating reflects monthly scores for the calendar

year 2007 and is based on four major areas: on-time performance, denied boardings, mishandled baggage, and

customer complaints. Researchers at the University of Nebraska at Omaha Aviation Institute and the W. Frank

Barton School of Business at Wichita State University conduct the study each year.

39