Airtran 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain Risk Factors Relating to Our Securities

Our securities have been and may continue to be adversely affected by conditions in the global financial

markets and economic conditions generally.

Since mid-2007, and particularly during the second half of 2008, the air carrier industry and the securities

markets generally were materially and adversely affected by significant declines in the values of nearly all asset

classes and by a serious lack of liquidity. This was initially triggered by rapid and all time high fuel prices and

general macroeconomic conditions, especially with regard to the housing and financial industries.

We may incur substantially more debt or take other actions that may affect our ability to satisfy our

existing debt obligations including under our 7% Convertible Notes and under our 5.5% Convertible

Senior Notes (collectively, the “Notes”).

We are not restricted under the terms of the Notes or the respective indentures for the Notes from incurring

substantial additional indebtedness in the future, including secured indebtedness or indebtedness at the

subsidiary level, to which the Notes would be structurally subordinated. In addition, the limited covenants

applicable to the Notes do not require us to achieve or maintain any minimum financial results relating to our

financial position or results of operations. The governing indentures do not contain any restrictive covenants

limiting our ability to pay dividends, make any payments on junior or other indebtedness, or otherwise limit our

financial condition. Our ability to recapitalize, incur additional debt and take a number of other actions that are

not limited by the terms of the Notes could have the effect of diminishing our ability to make payments on the

Notes when due, and require us to dedicate a substantial portion of our cash flow from operations to payments

on our indebtedness, which would reduce the availability of cash flow to fund our operations, working capital

and capital expenditures.

We may not have the ability to repurchase our 5.5% Convertible Senior Notes in cash upon the

occurrence of a fundamental change as required by the indenture governing the notes.

Holders of our 5.5% Convertible Senior Notes have the right to require us to repurchase the notes upon the

occurrence of a fundamental change. We may not have sufficient funds to repurchase such notes in cash or to

make the required repayment at such time or have the ability to arrange necessary financing on acceptable

terms. A fundamental change may also constitute an event of default under, or result in the acceleration of the

maturity of, our then-existing indebtedness. Our ability to repurchase our 5.5% Convertible Senior Notes in

cash may be limited by law or the terms of other agreements relating to our indebtedness outstanding at the

time. Our failure to repurchase our 5.5% Convertible Senior Notes when required would result in an event of

default with respect to such notes and could result in a cross default with respect to certain of our indebtedness.

Our stock price has been volatile historically and may continue to be volatile. The price of our common

stock, and therefore the price of the Notes, may fluctuate significantly, which may make it difficult for

holders to resell the Notes or the shares of our common stock issuable upon conversion of the Notes when

desired or at attractive prices.

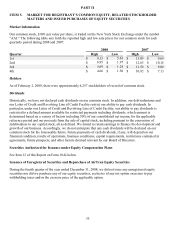

The trading price of our common stock has been and may continue to be subject to wide fluctuations. From

January 1, 2007 through February 2, 2009, the sale price of our common stock on the New York Stock

Exchange ranged from $1.28 to $13.09 per share, and the last reported sale price of our common stock on

February 2, 2009 was $4.11 per share.

28