Airtran 2008 Annual Report Download - page 83

Download and view the complete annual report

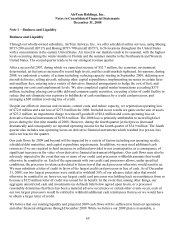

Please find page 83 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159 (SFAS 159), The

Fair Value Option for Financial Assets and Financial Liabilities. The fair value option established by SFAS

159 permits, but does not require, all entities to measure eligible items at fair value, as measured in accordance

with SFAS 157, at specified election dates. An entity would report unrealized gains and losses on items for

which the fair value option has been elected in earnings at each subsequent reporting date. SFAS 159 is

effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007. Although we

adopted SFAS 159 as of January 1, 2008, we have not yet elected the fair value option for any items permitted

under SFAS 159.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (Revised 2007)

(SFAS 141R), Business Combinations. SFAS 141R establishes principles and requirements for how an acquirer:

(a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed,

and any noncontrolling interest in the acquiree; (b) recognizes and measures the goodwill acquired in the

business combination or a gain from a bargain purchase; and (c) determines what information to disclose to

enable users of the financial statements to evaluate the nature and financial effects of the business combination.

In addition, material adjustments made to the initial acquisition purchase accounting will be required to be

recorded back to the acquisition date. SFAS 141R is effective for us on a prospective basis for transactions

occurring in 2009. SFAS 141R may have a material impact on our consolidated results of operations, balance

sheets and cash flows if we enter into material business combinations after the standard’s effective date.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160 (SFAS 160),

Noncontrolling Interests in Consolidated Financial Statements—An Amendment of ARB No. 51. SFAS 160

establishes new accounting and reporting standards for the non-controlling interest in a subsidiary and for the

deconsolidation of a subsidiary. SFAS 160 is effective for fiscal years beginning on or after December 15, 2008.

We do not currently expect the adoption of SFAS 160 to have a material impact on our consolidated financial

position, results of operations, and cash flows.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161 (SFAS 161),

Disclosures about Derivative Instruments and Hedging Activities—An Amendment of FASB Statement No. 133.

SFAS 161 applies to all derivative instruments and related hedged items accounted for under FASB Statement

No. 133 (SFAS 133), Accounting for Derivative Instruments and Hedging Activities. It requires entities to

provide greater transparency about: (a) how and why an entity uses derivative instruments; (b) how derivative

instruments and related hedged items are accounted for under SFAS 133 and its related interpretations; and

(c) how derivative instruments and related hedged items affect an entity’s financial position, results of

operations, and cash flows. We adopted SFAS 161 for the year ended December 31, 2008. Because SFAS 161

applies only to financial statement disclosures, it did not have any impact on our consolidated financial position,

results of operations, and cash flows.

In May 2008, the FASB issued Statement of Financial Accounting Standards No. 162 (SFAS 162), The

Hierarchy of Generally Accepted Accounting Principles. SFAS 162 identifies the sources of accounting

principles and the framework for selecting the principles to be used in the preparation of financial statements of

nongovernmental entities that are presented in conformity with generally accepted accounting principles

(GAAP) in the United States (the GAAP hierarchy). Because SFAS 162 applies only to establishing hierarchy,

it will not have a material impact on our consolidated financial position, results of operations, and cash flows.

75