Airtran 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.be indicators of potential impairment triggering events included record high fuel prices, significant losses

incurred in the first and second quarters of 2008, a softening U.S. economy, and a significant decrease in the

fair value of our outstanding equity and debt securities during 2008, including a decline in the market price of

our common stock relative to the net book value per share of our common stock.

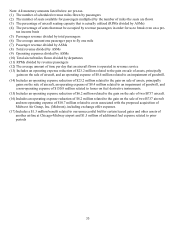

As a result of this impairment testing, we recorded goodwill impairment charges of approximately $8.4 million

in 2008. We performed the annual impairment test of the financial statement carrying value of our trade name

and trademarks which test indicated that there was not an impairment. However, we still have approximately

$1.2 billion of operating property and equipment and $21.6 million of intangible assets that could be subject to

impairment. We may be required to recognize additional impairments in the future due to, among other factors,

continuing operating losses, extreme fuel price volatility, tight credit markets, the decline in our market

capitalization and in the fair value of our debt securities, the uncertain economic environment, and other

uncertainties. We cannot assure you that a material impairment charge related to our intangible assets or

tangible assets, including aircraft, will not occur in a future period. The value of our aircraft could be impacted

in future periods by changes in the market for these aircraft. Such changes could result in a greater supply and

lower demand for certain aircraft types as other carriers are selling and/or grounding aircraft. An impairment

charge could have a material adverse effect on our financial position and results of operations in the period of

recognition. See ITEM 7. “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS – Critical Accounting Policies and Estimates.”

Our ability to utilize net operating loss carryforwards may be limited.

At December 31, 2008, we had estimated net operating loss carryforwards (“NOLs”) of $428.0 million for

federal income tax purposes that expire beginning in 2017 and continuing through 2028. Section 382 of the

Internal Revenue Code (“Section 382”) imposes limitations on a corporation’s ability to utilize NOLs if it

experiences an “ownership change.” In general terms, an ownership change may result from transactions

increasing the ownership of certain stockholders in the stock of a corporation by more than 50 percentage points

over a three-year period.

In the event of an ownership change, utilization of our NOLs would be subject to an annual limitation under

Section 382 determined by multiplying the aggregate value of our stock at the time of the ownership change by

the applicable long-term tax-exempt rate (which was 5.4% for as of December 31, 2008). Any unused NOLs in

excess of the annual limitation may be carried over to later years. Based on analysis that we performed, we

believe we have not experienced a change in ownership as defined by Section 382, and, therefore, our NOLs are

not currently under any Section 382 limitation.

As a result of our common stock trading at depressed market prices in the last year (relative to the prices at

which our stock has generally traded during the previous three-year period), the costs associated with acquiring

a sufficient number of shares of our common stock to become a holder of 5% or more of the outstanding shares

has decreased significantly. This decline in the cost of reaching the 5% ownership threshold may increase the

likelihood that we will experience an “ownership change” for purposes of Section 382, as increases in share

holdings by, or that result in a person becoming, a holder of 5% or more of the outstanding shares of our

common stock are aggregated for purposes of determining whether such a change has occurred. Although we

cannot currently predict whether or when such an “ownership change” may occur, if we were to experience an

ownership change under current conditions, our annual NOL utilization could be significantly limited. The

imposition of this limitation on our ability to use our NOLs to offset future taxable income could cause U.S.

federal income taxes to be paid earlier than otherwise would be paid if such limitation were not in effect and

could cause such NOLs to expire unused, reducing or eliminating the benefit of such NOLs. In addition,

depending on the market value of our common stock at the time of any such ownership change, we may be

required to recognize a significant non-cash tax charge, the amount of which we cannot estimate at this time.

27