Airtran 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

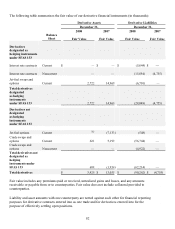

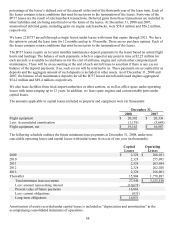

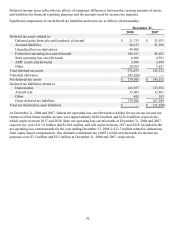

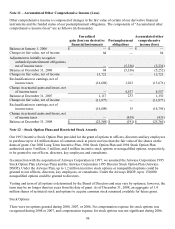

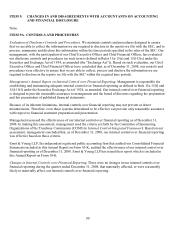

Deferred income taxes reflect the tax effects of temporary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the amounts used for income tax purposes.

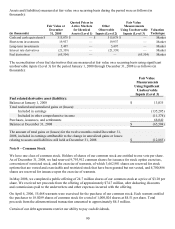

Significant components of our deferred tax liabilities and assets are as follows (in thousands):

December 31,

2008 2007

Deferred tax assets related to:

Deferred gains from sale and leaseback of aircraft $ 21,733 $ 21,073

Accrued liabilities 26,353 21,938

Unrealized loss on derivatives 49,906

—

Federal net operating loss carryforwards 146,521 88,623

State operating loss carryforwards 8,098 4,593

AMT credit carryforwards 3,300 3,498

Other 20,764 5,627

Total deferred tax assets 276,675 145,352

Valuation allowance (97,169)

—

Net deferred tax assets $ 179,506 $ 145,352

Deferred tax liabilities related to:

Depreciation 143,957 133,592

Aircraft rent 35,064 32,865

Other 485 553

Gross deferred tax liabilities 179,506 167,010

Total net deferred tax asset (liability) $

—

$ (21,658)

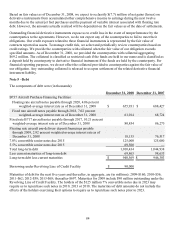

At December 31, 2008 and 2007, federal net operating loss carryforwards available for use on our income tax

returns to offset future taxable income were approximately $428.0 million and $256.0 million, respectively,

which expire between 2017 and 2028. State net operating loss carryforwards at December 31, 2008 and 2007,

respectively, were $117.6 million and $110.8 million, and will expire between 2017 and 2028. Included in the

net operating loss carryforwards for the year ending December 31, 2008 is $13.7 million related to deductions

from equity-based compensation. Our alternative minimum tax (AMT) credit carryforwards for income tax

purposes were $3.3 million and $3.5 million at December 31, 2008 and 2007, respectively.

92