Airtran 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

There can be no assurance that sufficient financing will be available for all B737 aircraft deliveries or for other

capital expenditures not covered by firm financing commitments. If we are unable to generate revenues to cover

our costs, we may slow our growth, including by the sale, lease, or sublease of certain of our existing or on-

order aircraft.

During the year ended December 31, 2008, we sold eight B737 aircraft and recognized an aggregate gain of

$20.1 million related to the sales of these aircraft. In August 2008, we also returned one leased B717 aircraft to

the lessor. During the year ended December 31, 2007, we took delivery of and subsequently sold two B737

aircraft. We recognized a gain of $6.2 million during the year ended December 31, 2007 related to the sales of

these aircraft. The gain on sales of the aircraft is classified as a component of operating expense.

During October 2008, we completed a sale-leaseback financing transaction of three spare aircraft engines. We

realized an aggregate cash benefit of $12.7 million related to the sale-leaseback transaction.

In October 2008, as part of our agreement to defer certain aircraft deliveries and obtain backstop financing for

other aircraft deliveries, we granted an affiliate of Boeing the right to require us to lease, for a period not to

exceed ten years, up to five B717 aircraft. We have no obligation to accept delivery of more than four aircraft in

total (i.e., B737 deliveries and B717 leased aircraft) in 2009. If such affiliate exercises its right to require us to

lease any B717 aircraft, we have the option to cancel firm B737 aircraft on order for each such B717 aircraft to

be leased to us.

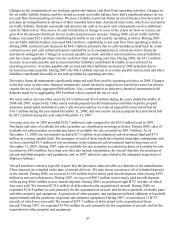

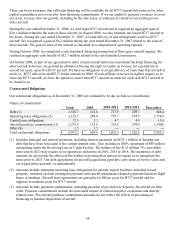

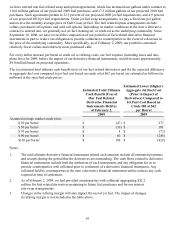

Contractual Obligations

Our contractual obligations as of December 31, 2008 are estimated to be due as follows (in millions):

Nature of commitment

Total 2009 2010-2011 2012-2013 Thereafter

Debt (1) 1,501.7 212.0 213.0 208.3 868.4

Operating lease obligations (2) 3,125.5 288.0 539.7 518.9 1,778.9

Capital lease obligations 27.5 2.3 4.7 4.6 15.9

Aircraft

p

urchase commitments

(

3

)

2

,

275.0 135.0 255.0 595.0 1

,

290.0

Other (4) 1.5 1.5

—

—

—

Total contractual obligations $ 6,931.2 $ 638.8 $ 1,012.4 $ 1,326.8 $ 3,953.2

(1) Includes principal and interest payments, including interest payments on $674.1 million of floating rate

debt that have been forecasted at the current interest rates. Also includes in 2009, repayment of $90 million

outstanding under the Revolving Line of Credit Facility. The holders of the $125 million 7% convertible

notes due in 2023 may require us to repurchase such notes in 2010, 2013 or 2018. The maturities of debt

amounts do not include the effects of the holders exercising their options to require us to repurchase the

notes prior to 2023. Our debt agreements for aircraft acquisitions generally carry terms of twelve years and

are repaid either quarterly or semiannually.

(2) Amounts include minimum operating lease obligations for aircraft, airport facilities, and other leased

property. Amounts exclude contingent payments and aircraft maintenance deposit payments based on flight

hours or landings. Aircraft lease agreements are generally for fifteen years for B737 aircraft and for

eighteen to nineteen years for B717 aircraft.

(3) Amounts include payment commitments, including payment of pre-delivery deposits, for aircraft on firm

order. Payment commitments include the forecasted impact of contractual price escalations and directly

related costs. The aircraft purchase commitment amounts do not reflect the effects of pre-arranged

financing or planned disposition of aircraft.

54