Airtran 2008 Annual Report Download - page 88

Download and view the complete annual report

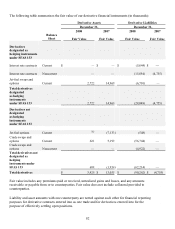

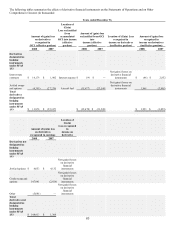

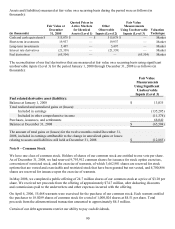

Please find page 88 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 4 – Financial Instruments

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of

cash and cash equivalents, restricted cash, short-term and long-term investments, accounts receivable, and

derivative financial instruments (including deposits held by counterparties). We maintain cash and cash

equivalents and short-term investments in what we believe are high credit-quality financial institutions or in

what we believe are in short-duration, high-quality debt securities. Investments are stated at fair value. We

periodically evaluate the relative credit standing of those financial institutions that are considered in our

investment strategy. We use specific identification of securities for determining gains and losses. All of our

investments are available for sale securities. As of December 31, 2008, we had short-term and long-term

investments, of $19.9 million and $5.5 million, respectively, consisting of $17.5 million in an enhanced cash

investment fund and $7.9 million in a money market fund. The managers of the funds have limited immediate

redemptions and we have classified $5.5 million of our investment in the enhanced cash investment fund as

long-term as of December 31, 2008. During 2008 and 2007, we recorded charges of $5.2 million and $1.1

million, respectively, to interest income for realized and unrealized losses on these funds. There were no

material realized or unrealized gains or losses on our available-for-sale securities for the year ended

December 31, 2006.

The estimated fair value of other financial instruments, excluding debt, approximates their carrying amount.

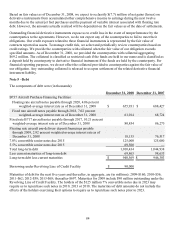

The financial statement carrying amounts and estimated fair values of debt and capital leases were $1.1 billion

and $1.0 billion, respectively, at December 31, 2008, and $1.1 billion and $1.1 billion, respectively, at

December 31, 2007. The estimated fair value of debt is based upon discounted future cash flows using

estimated incremental borrowing rates for similar types of instruments or market prices. Our 7% and 5.5%

convertible notes trade from time to time. We used market prices to value the unsecured convertible notes. A

majority of our other debt consists of floating rate notes secured by B737 aircraft. Given the relatively high

quality of the underlying collateral, we valued the floating rate B737 aircraft purchase facility debt at par. We

valued the fixed rate notes secured by aircraft at a discount to par consistent with observed discounts on

comparable traded debt. Given the current turmoil in the credit markets, there is an unusual amount of

uncertainty associated with valuing all securities, including our debt securities.

The majority of our receivables result from the sale of tickets to individuals, mostly through the use of major

credit cards. These receivables are short-term, generally being settled shortly after sale subject to any applicable

holdbacks.

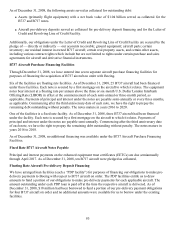

We enter into various derivative financial instruments with financial institutions to seek to reduce the variability

of the ultimate cash flows associated with fluctuations in jet fuel prices. We enter into both fuel related swap

and option derivative financial arrangements. We do not hold or issue derivative financial instruments for

trading purposes. As of December 31, 2008, we have entered into fuel related swap and option agreements,

which pertain to 32.2 million gallons of our projected 2009 fuel purchases, and 9.1 million gallons of our

projected 2010 fuel purchases. Such agreements pertain to 9.1 percent of our projected 2009 jet fuel

requirements, and 2.5 percent of our projected 2010 jet fuel requirements. Based on actions subsequent to year

end, as of February 2, 2009, we have entered into fuel related swap and option agreements, which has increased

our gallons under contract to 116.0 million gallons of our projected 2009 fuel purchases, and 17.3 million

gallons of our projected 2010 fuel purchases. Such agreements pertain to 32.5 percent of our projected 2009 jet

fuel requirements, and 4.9 percent of our projected 2010 jet fuel requirements. Under jet fuel swap

arrangements, we pay a fixed rate per gallon and receive the monthly average price of Gulf Coast jet fuel. The

fuel related option arrangements include collars, purchased call options, and sold call options. Depending on

market conditions at the time a derivative contract is entered into, we generally use jet fuel, heating oil, or crude

oil as the underlying commodity.

80