Airtran 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other 2008 Accomplishments

During 2008, we:

• Carried in excess of 24.6 million revenue passengers;

• Joined the major trade association for the industry, Air Transport Association (ATA), while also retaining

membership in the Air Carrier Association of America (ACAA);

• Initiated service to Burlington, Vermont; Columbus, Ohio; Harrisburg, Pennsylvania; San Antonio,

Texas; and San Juan, Puerto Rico;

• Launched 22 new non-stop routes such as Milwaukee-New York LaGuardia; and Baltimore/Washingto

n

International – Los Angeles, California;

• Developed new functionality for A+ Rewards members at http://www.airtran.com including the ability to

purchase additional credits, extend expiring credits, or give credits to other members;

• Increased the value of the A+ Rewards Elite program by adding upgrade opportunities for Elite fliers at

the gate and improving conveniences at the airport; and

• Announced that we will begin service to Branson, Missouri and Cancun, Mexico in 2009.

We expect our mix of low fares, excellent customer service, an affordable Business Class product, and one of

the youngest all-Boeing aircraft fleets will provide product value that customers will continue to find attractive.

2009 Outlook

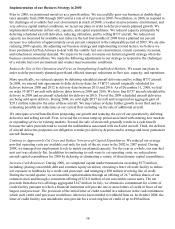

We will face challenges during 2009. Managing costs and increasing unit revenues in the face of volatile fuel

costs and a weak economy will continue to be a primary focus. While fuel market prices have recently

decreased dramatically, fuel prices remain volatile and may again increase in 2009. Additionally, our 2009

revenues may be adversely impacted by recessionary macroeconomic conditions in the United States. The

pilots’ collective bargaining agreement became amendable in 2005 and is currently in mediation and the flight

attendants’ collective bargaining agreement became amendable on December 1, 2008; the impact on our

operating results of any new collective bargaining agreement is uncertain.

Based on our current outlook, we expect to reduce capacity as measured by available seat miles by

approximately four percent for 2009 compared to 2008. Additionally, we expect our 2009 non-fuel unit

operating costs per available seat mile to increase six to seven percent compared to 2008. We expect our non-

fuel unit operating costs to increase primarily due to: increases in aircraft maintenance costs due to the aging of

both aircraft types, a contract cost increase for B717 engine repairs, and an increased number of heavy airframe

checks for our B717 aircraft; higher employee compensation costs due to higher wage rates attributable to

higher average employee seniority; increased pilot training expenses; higher airport rents and landing fees; and

a higher percentage of leased aircraft. Our fuel costs in the first quarter 2009 are estimated to be between $1.80

and $1.85 per gallon, including taxes, transportation, and into-plane fees and excluding the impact of our fuel

risk management program. This assumes $47 a barrel crude oil and an $18 jet fuel refining margin.

Air travel in our markets tends to be seasonal, with the highest levels occurring during the winter months to

Florida and the summer months to the Northeastern and Western United States. The second quarter tends to be

our strongest revenue quarter.

40