Whirlpool 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

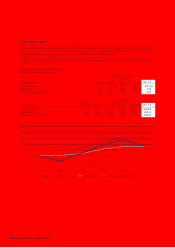

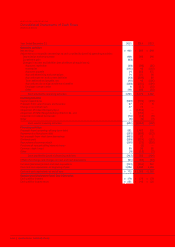

FREE CASH FLOW

As defined by the company, free cash flow is cash provided by operating activities after capital expenditures, proceeds from the

sale of assets and businesses and changes in restricted cash. The reconciliation provided below reconciles twelve-month 2015,

2014 and 2013 free cash flow with cash provided by operating activities, the most directly comparable GAAP financial measure.

The change in restricted cash relates to the private placement funds paid by Whirlpool to acquire majority control of Hefei Sanyo

in 2014 and which are used to fund capital and technical resources to enhance Whirlpool China’s research and development and

working capital.

Twelve Months Ended December 31,

(Millions of dollars) 2015 2014 2013

Cash provided by operating activities $ 1,225 $ 1,479 $ 1,262

Capital expenditures, proceeds from sale of assets/businesses and changes in restricted cash (605) (625) (572)

Free cash flow $ 620 $ 854 $ 690

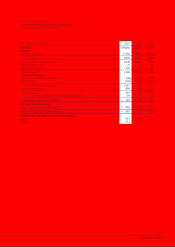

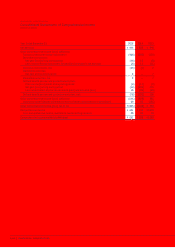

ONGOING BUSINESS OPERATIONS MEASURES, OPERATING PROFIT AND EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures, ongoing business operating profit and ongoing

business earnings per diluted share, with the most directly comparable GAAP financial measures, reported operating profit and

net earnings per diluted share available to Whirlpool, for the twelve months ended December 31, 2015, December 31, 2014 and

December 31, 2013. Ongoing business operating margin is calculated by dividing ongoing business operating profit by ongoing

business net sales. Ongoing business net sales excludes Brazilian (BEFIEX) tax credits from reported net sales. For more infor-

mation, see document titled “GAAP Reconciliations” at investors.whirlpoolcorp.com/annuals-proxies.cfm.

Twelve Months Ended December 31,

Operating Profit Earnings per Diluted Share

(Millions of dollars, except per share data) 2015 2014 2013 2015 2014 2013

Reported GAAP Measure $ 1,285 $ 1,188 $ 1,249 $ 9.83 $ 8.17 $ 10.24

Brazilian (BEFIEX) Tax Credits —(14) (109) —(0.18) (1.35)

Restructuring Expense 201 136 196 2.03 1.34 1.84

Investment Expenses —52 6 —0.86 0.19

Combined Acquisition Related Transition Costs 57 98 — 0.66 1.09 —

Inventory Purchase Price Allocation —13 — —0.13 —

Antitrust and Dispute Resolutions 21 2 — 0.35 0.04 0.40

Gain/Expenses Related to a Business Investment —— — (0.44) — —

U.S. Energy Tax Credits —— — —— (1.56)

Brazilian Government Settlement —— 11 —— 0.26

Pension Settlement Charges 15 — — 0.16 — —

Benefit Plan Curtailment Gain (62) — — (0.63) — —

Legacy Product Warranty and Liability Expense 42 — — 0.42 — —

Normalized Tax Rate Adjustment —— — —(0.06) —

Ongoing Business Measure $ 1,559 $ 1,475 $ 1,353 $ 12.38 $ 11.39 $ 10.02

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on

our behalf. Certain statements contained in this annual report, including those within the forward-looking perspective section

of this annual report, and other written and oral statements made from time to time by us or on our behalf do not relate strictly

to historical or current facts and may contain forward-looking statements that reflect our current views with respect to future

events and financial performance. As such, they are considered “forward-looking statements” which provide current expecta-

tions or forecasts of future events. Such statements can be identified by the use of terminology such as “may,” “could,” “will,”

“should,” “possible,” “plan,” “predict,” “forecast,” “potential,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,”

“may impact,” “on track,” and similar words or expressions. Our forward-looking statements generally relate to our growth

strategies, financial results, product development, and sales efforts. These forward-looking statements should be considered

with the understanding that such statements involve a variety of risks and uncertainties, known and unknown, and may be

affected by inaccurate assumptions. Consequently, no forward-looking statement can be guaranteed and actual results may

vary materially.

2015 WHIRLPOOL CORPORATION