Vodafone 2002 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements96

Notes to the Consolidated Financial Statements continued

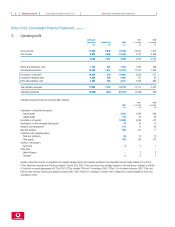

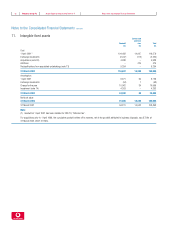

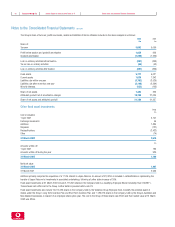

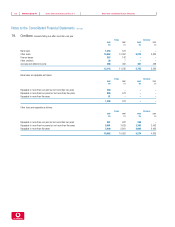

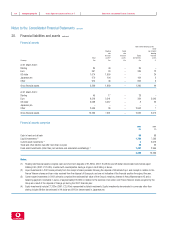

The Group’s share of turnover, profits and losses, assets and liabilities of Verizon Wireless included in the above analysis is as follows:

2002 2001

£m £m

Share of:

Turnover 5,602 5,000

Profit before taxation and goodwill amortisation 1,058 926

Goodwill amortisation (1,259) (1,229)

Loss on ordinary activities before taxation (201) (303)

Tax on loss on ordinary activities (66) (53)

Loss on ordinary activities after taxation (267) (356)

Fixed assets 5,777 5,027

Current assets 1,678 1,342

Liabilities due within one year (3,782) (3,529)

Liabilities due after more than one year (2,148) (2,394)

Minority interests (123) (123)

Share of net assets 1,402 323

Attributed goodwill net of amortisation charges 19,748 21,034

Share of net assets and attributed goodwill 21,150 21,357

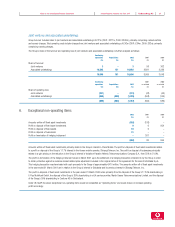

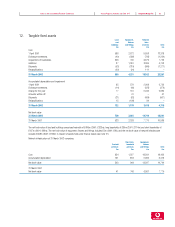

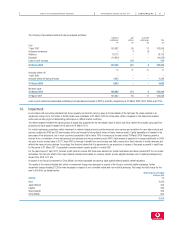

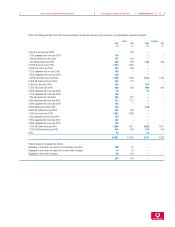

Other fixed asset investments

Group

£m

Cost or valuation

1 April 2001 3,141

Exchange movements 55

Additions 1,884

Disposals (121)

Reclassifications (2,432)

Other (14)

31 March 2002 2,513

£m

Amounts written off

1 April 2001 186

Amounts written off during the year 920

31 March 2002 1,106

Net book value

31 March 2002 1,407

31 March 2001 2,955

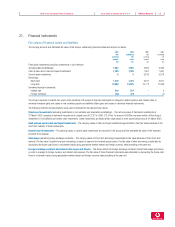

Additions primarily comprise the acquisition of a 17.5% interest in Japan Telecom. An amount of £2,429m is included in reclassifications, representing the

transfer of Japan Telecom to investments in associated undertakings, following a further stake increase of 20%.

Fixed asset investments at 31 March 2002 include 2,113,243 shares in the Company held by a Qualifying Employee Share Ownership Trust (“QUEST”).

These shares had a £Nil cost to the Group. Further detail is provided within note 23.

Fixed asset investments also include 15,074,436 shares in the Company, held by the Vodafone Group Employee Trust, to satisfy the potential award of

shares under the Group’s Long Term Incentive Plan and Short Term Incentive Plan, and 7,189,316 shares in the Company, held by the Group’s Australian and

New Zealand businesses, in respect of an employee share option plan. The cost to the Group of these shares was £33m and their market value at 31 March

2002 was £29m.