Vodafone 2002 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements122

Notes to the Consolidated Financial Statements continued

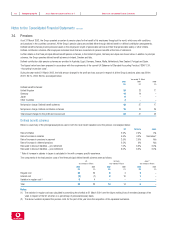

34. Pensions continued

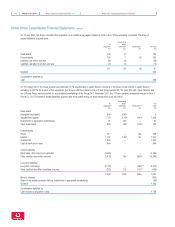

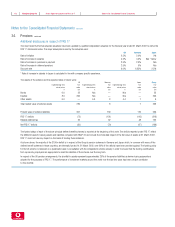

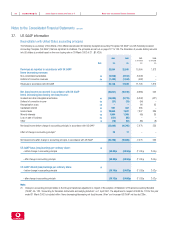

Additional disclosures in respect of FRS 17

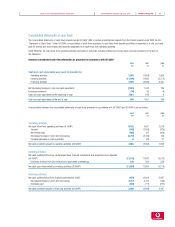

The most recent full formal actuarial valuations have been updated by qualified independent actuaries for the financial year ended 31 March 2002 to derive the

FRS 17 disclosures below. The major assumptions used by the actuaries were:

UK Germany Japan

Rate of inflation 2.5% 2.0% 0%

Rate of increase in salaries 4.5% 4.0% See * below

Rate of increase in pensions in payment 2.5% 2.0% N/a

Rate of increase in deferred pensions 2.5% 0% N/a

Discount rate 6.0% 6.25% 2.5%

* Rate of increase in salaries in Japan is calculated in line with company specific experience.

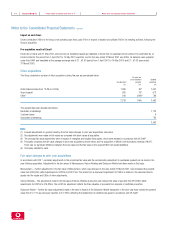

The assets of the scheme and the expected rates of return were:

UK Germany Japan Group

Expected long term Fair Expected long term Fair Expected long term Fair Fair

rate of return value rate of return value rate of return value value

%£m %£m %£m£m

Bonds 6.0 23 N/a —N/a —23

Equities 8.0 206 N/a —N/a —206

Other assets 6.0 —6.0 8 4.4 1 9

Total market value of scheme assets 229 8 1 238

Present value of scheme liabilities 301 139 116 556

FRS 17 deficits (72) (131) (115) (318)

Related deferred tax 22 52 48 122

Net FRS 17 deficits (50) (79) (67) (196)

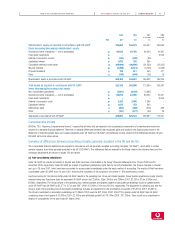

The funded status of each of the above principal defined benefit schemes is reported at the beginning of this note. The deficits reported under FRS 17 reflect

the different bases for valuing assets and liabilities compared with SSAP 24 and include the immediate impact of the fair value of assets at 31 March 2002.

FRS 17 does not have any impact on the basis of funding these schemes.

As shown above, the majority of the £196m deficit is in respect of the Group’s pension schemes in Germany and Japan which, in common with many of the

defined benefit schemes in those countries, are internally funded. At 31 March 2002, over 90% of the deficits have been provided against. The funding policy

for the UK scheme is reviewed on a systematic basis in consultation with the independent scheme actuary in order to ensure that the funding contributions

from sponsoring employers are appropriate to meet the liabilities of the scheme over the long term.

In respect of the UK pension arrangements, the shortfall in assets represents approximately 25% of the pension liabilities as derived using assumptions

adopted for the purposes of FRS 17. The performance of investment markets around the world over the last two years has been a major contributor

to this shortfall.