Vodafone 2002 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements116

Notes to the Consolidated Financial Statements continued

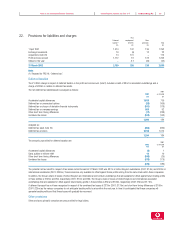

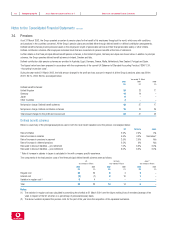

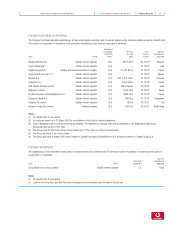

28. Capital commitments

2002 2001

£m £m

Tangible and intangible fixed asset expenditure contracted for but not provided 816 861

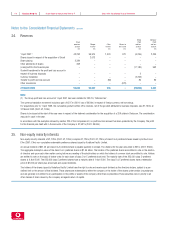

In addition to the commitments above, the Group has granted put options over certain interests in its businesses held by minority shareholders, as described

in more detail below.

Vodafone Egypt – Vivendi Telecom International holds a put option in respect of its 7% shareholding in Vodafone Egypt. As disclosed in note 35, Vivendi Telecom

International has exercised the put option. The shares will be purchased at market value.

Airtel – Acciona and Tibest are party to a put option which requires the Group to purchase approximately 6.2% of Airtel for an amount up to approximately

12.0 billion. Acciona may exercise the option at any time up to 21 January 2003. If the option has not been exercised by 21 January 2003 it will be deemed

exercised on that date.

Airtel –Torreal S.A. had a put option which required the Group to purchase shares representing approximately 2.2% of Airtel. On 2 April 2002, the Group

announced that, pursuant to this agreement, it had acquired the shares in Airtel required for the euro equivalent of £0.4 billion, increasing the Group’s equity

interest in Airtel to 93.8%.

Vodafone Pacific – At 31 March 2002, Hastings Fund Management had exercised a put option over their 4.5% interest in Vodafone Pacific at fair market value.

On 3 May 2002, pursuant to this agreement, the Group completed the purchase of the 4.5% minority interest in Vodafone Pacific, as a result of which Vodafone

Pacific became a wholly owned subsidiary undertaking.

Details of other business acquisitions completed after 31 March 2002 are included in note 35, “Subsequent events”.

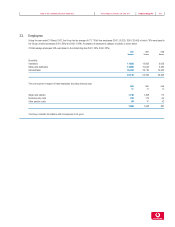

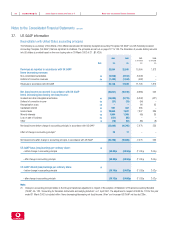

29. Contingent liabilities

Group Company

2002 2001 2002 2001

£m £m £m £m

Guarantees and indemnities of bank or other facilities including

those in respect of the Group’s joint ventures, associated undertakings and investments 412 1,339 1,910 1,223

In addition, at 31 March 2002, the Company and its subsidiary, Vodafone AG, had guaranteed financial indebtedness or issued performance bonds for

£258m in respect of businesses which have subsequently been sold and for which counter indemnities have been received from the purchasers and the

Group had issued performance bonds with an aggregate value of £1,829m in respect of undertakings to roll out second and third generation networks by its

subsidiaires in Spain and Germany and a further £97m in respect of other obligations in relation to operating leases or performance.