Vodafone 2002 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements104

Notes to the Consolidated Financial Statements continued

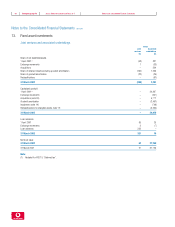

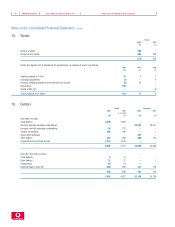

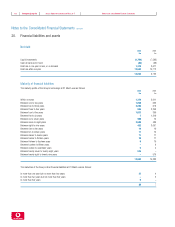

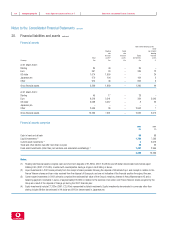

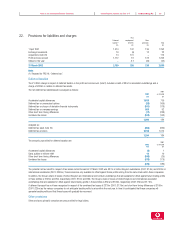

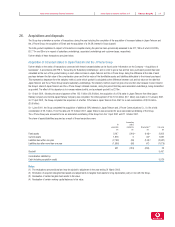

20. Financial liabilities and assets continued

Financial assets

Non-interest bearing assets

Other

Floating Fixed non-interest

rate rate bearing

financial financial Equity financial

Total assets(1) assets investments assets

Currency £m £m £m £m %

At 31 March 2002:

Sterling 84 49 –35 –

Euro 367 20 –335 12

US dollar 1,674 1,650 ––24

Japanese yen 270 104 –164 2

Other 914 46 –862 6

Gross financial assets 3,309 1,869 –1,396 44

At 31 March 2001:

Sterling 45 17 –28 –

Euro 8,518 2,541 –334 5,643

US dollar 5,098 5,067 –823

Japanese yen –––––

Other 2,605 36 – 2,562 7

Gross financial assets 16,266 7,661 – 2,932 5,673

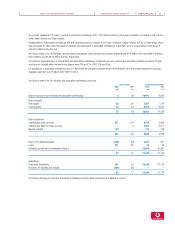

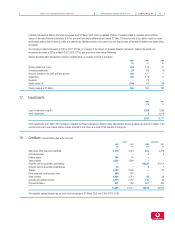

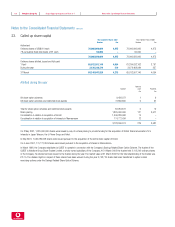

Financial assets comprise

2002 2001

£m £m

Cash in hand and at bank 80 68

Liquid investments (2) 1,789 7,593

Current asset investments (3) 35,618

Trade and other debtors due after more than one year 30 32

Fixed asset investments (other than joint ventures and associated undertakings) (4) 1,407 2,955

3,309 16,266

Notes:

(1) Floating rate financial assets comprise cash and short-term deposits of £1,865m (2001: £4,484m) and US dollar denominated commercial paper

totalling £4m (2001: £1,162m), invested with counterparties having a single-A credit rating or above.

(2) Liquid investments in 2001 arose primarily from the receipt of sales proceeds following the disposal of Infostrada S.p.A. and receipts in relation to the

France Telecom shares and loan notes received from the disposal of Orange plc and are not indicative of the financial position throughout the year.

(3) Current asset investments in 2001 primarily comprised the estimated fair value of the Group’s remaining interest in Atecs Mannesmann AG and a

balancing payment, receivable in euros, of approximately £3,092m in relation to the exercise of an option over France Telecom shares acquired by the

Group as a result of the disposal of Orange plc during the 2001 financial year.

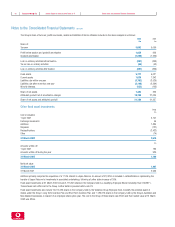

(4) Equity investments include £1,333m (2001: £2,510m) represented by listed investments. Equity investments denominated in currencies other than

sterling include £848m denominated in HK dollar and £115m denominated in Japanese yen.