Vodafone 2002 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements Vodafone Group Plc 117Annual Report & Accounts and Form 20-F

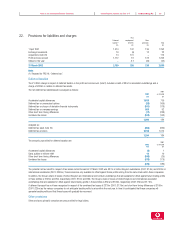

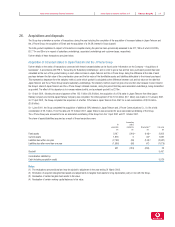

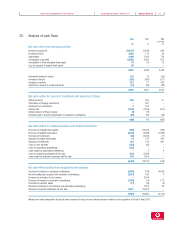

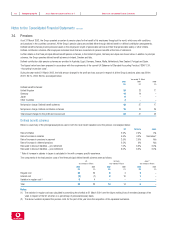

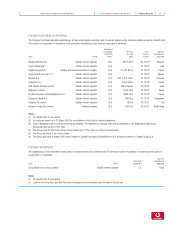

30. Analysis of cash flows

2002 2001 2000

as restated

£m £m £m

Net cash inflow from operating activities

Operating (loss)/profit (10,377) (6,439) 983

Exceptional items 4,486 176 30

Depreciation 2,880 1,593 746

Amortisation of goodwill 10,962 9,585 672

Amortisation of other intangible fixed assets 34 24 12

Loss on disposal of tangible fixed assets 46 ––

8,031 4,939 2,443

Decrease/(increase) in stocks 125 15 (65)

Increase in debtors (242) (350) (271)

Increase in creditors 215 67 433

Payments in respect of exceptional items (27) (84) (30)

8,102 4,587 2,510

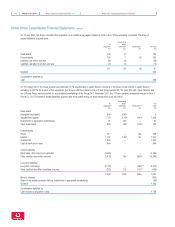

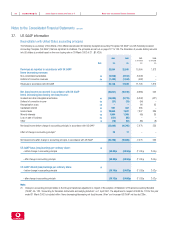

Net cash outflow for returns on investments and servicing of finance

Interest received 259 296 57

Termination of hedging instruments –901 –

Dividends from investments 2102 –

Interest paid (1,104) (1,254) (370)

Interest element of finance leases (9) (11) –

Dividends paid to minority shareholders in subsidiary undertakings (84) (81) (93)

(936) (47) (406)

Net cash outflow for capital expenditure and financial investment

Purchase of intangible fixed assets (325) (13,163) (185)

Purchase of tangible fixed assets (4,145) (3,698) (1,848)

Purchase of investments (44) (3,254) (17)

Disposal of tangible fixed assets 75 275 294

Disposal of investments 319 513 991

Loans to joint ventures (233) (85) –

Loans to associated undertakings (523) ––

Loans repaid by associated undertakings –59

Loans to acquired businesses held for sale (116) (1,509) –

Loans repaid by acquired businesses held for sale 545 1,905 –

(4,447) (19,011) (756)

Net cash inflow/(outflow) from acquisitions and disposals

Purchase of interests in subsidiary undertakings (3,078) (219) (4,062)

Net (overdrafts)/cash acquired with subsidiary undertakings (2,514) 542 4

Proceeds on formation of joint venture –2,544 –

Purchase of interests in associated undertakings (7,159) (79) (717)

Purchase of customer bases (11) (15) (9)

Disposal of interests in joint ventures and associated undertakings –1,878 28

Disposal of acquired businesses held for sale 5,071 26,002 –

(7,691) 30,653 (4,756)

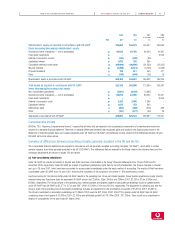

Material non-cash transactions during the year comprise the issue of new ordinary shares in relation to the acquisition of Eircell in May 2001.