Vodafone 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Board’s Report to Shareholders on Directors’ Remuneration62

Board’s Report to Shareholders on Directors’ Remuneration continued

awarding share options to employees who had not previously participated in the

Company’s share incentive arrangements. Executive directors do not receive GEM

options. It is intended that a similar option grant be made in July 2002.

Sharesave Options

The Vodafone Group 1998 Sharesave Scheme is an Inland Revenue approved

scheme open to all UK permanent employees.

The maximum that can be saved each month is £250 and savings plus interest

may be used to acquire shares by exercising the related option. The options have

been granted at up to a 20% discount to market value. Participants can elect

either a three or five year savings term. UK based executive directors are eligible

to participate in the scheme and details of their participation are given in the

table on page 66.

Profit Sharing Scheme

The Vodafone Group Profit Sharing Scheme is an Inland Revenue approved

scheme, which was open to all UK permanent employees until 31 March 2002.

Eligible employees were able to contribute up to 5% of their salary, up to a

monthly maximum of £665, to enable trustees of the scheme to purchase shares

on their behalf. An equivalent number of shares was purchased for the employee

with contributions made by the employing company. To receive the maximum

income tax relief afforded to this type of scheme, the trustees are requested to

retain shares for three years. As a consequence of new legislation, this scheme

was terminated at 31 March 2002 and has been replaced by the Vodafone

Group Share Incentive Plan from 1 April 2002 under which eligible employees

may contribute up to £125 each month, but which otherwise operates in a

similar way to the Profit Sharing Scheme. UK based executive directors were

eligible to participate in the Profit Sharing Scheme and are eligible to participate

in the Share Incentive Plan and details of their share interests under these plans

are given in the table on page 67.

Non-executive directors’ remuneration

The remuneration of non-executive directors is established by the whole Board.

Details of each non-executive director’s remuneration are included in the table

on page 63.

Non-executive directors are not eligible to receive awards under any of the

Company’s share schemes or other employee benefit schemes, nor does the

Company make any contribution to their pension arrangements.

Certain non-executive directors hold share options relating to their service with

AirTouch. No options have been granted to non-executive directors in their

capacity as non-executive directors of the Company.

Service contracts and appointments of directors

The Remuneration Committee has determined that, in the cases of UK based

executive directors, their appointments to the Board will be on the terms of a

contract that can be terminated by the Company at the end of an initial term of

two years or at any time thereafter on one year’s notice. Contracts on this basis

were granted to Julian Horn-Smith on 4 June 1996, to Sir Christopher Gent and

Ken Hydon on 1 January 1997 and to Peter Bamford on 1 April 1998, each of

which is now, therefore, terminable by the Company on one year’s notice.

The executive directors are required to give the Company one year’s notice if

they wish to terminate their contracts.

Thomas Geitner entered into a fixed term five-year contract with Vodafone AG

(formerly Mannesmann AG) on 15 May 2000. This is the normal contract

arrangement for Vodafone AG board members. Mr Geitner agreed to replace this

contract, without recompense, with a new contract that is for an initial three-year

term from June 2001 and which then is indefinite until terminated by either

party. The period of notice for termination is one year and termination notice may

not be given until the end of the initial three years.

Vittorio Colao entered into a contract with Omnitel Pronto Italia S.p.A. (now

operating as Omnitel Vodafone) on 22 July 1996. This contract is in accordance

with the National Collective Labour Agreement for “dirigenti”for industrial

companies in Italy, under which employees are required to give up to four

months notice to terminate and the employing company must give up to

12 months’ notice. Prior to Mr Colao’s appointment to the Board on 1 April

2002, the notice period for termination by Omnitel Vodafone was increased to

one year and the notice period from Mr Colao, in the event that he wishes to

leave to join a competitor of Omnitel Vodafone, was also increased to one year.

The appointment of the Chairman is subject to the terms of an agreement

between the Company and Lord MacLaurin with a three-year term that began on

23 May 2000. The Chairman is entitled to the provision of a car.

The other non-executive directors are engaged on letters of appointment

that set out their duties and responsibilities and confirm their remuneration.

The Company may terminate each of these appointments at any time without the

payment of compensation.

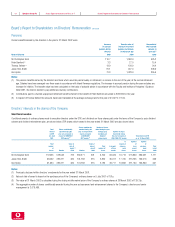

Remuneration for the Year to 31 March 2002

The aggregate compensation paid by Vodafone to its directors and senior

management* as a group for services in all capacities for the year ended

31 March 2002, is set out below. The aggregate number of directors and senior

management in the year ended 31 March 2002 was 23, compared to 25 in the

year ended 31 March 2001**.

2002 2001

£000 £000

Salaries and fees 7,329 5,986

Bonuses –13,589

Incentive schemes*** 6,541 3,033

Benefits 925 767

Compensation for loss of office –10,272

14,795 33,647

* Aggregate compensation for senior management is in respect of those

individuals who were members of the Executive Committee as at, and for the

year ended, 31 March 2002, other than executive directors.

** 10 of the 23 (2001: 14 of the 25) directors are non-executive directors.

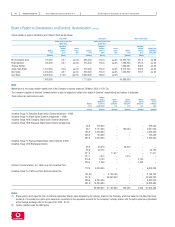

*** Comprises the incentive scheme information given in the table on page 63

with equivalent basis disclosures given for senior management. Details of

share incentives awarded to directors and senior management are included

in footnotes to the Short Term Incentive, Long Term Incentives and Share

Options tables on pages 64 and 65.