Vodafone 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

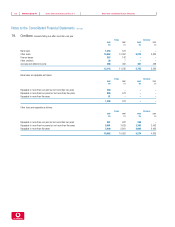

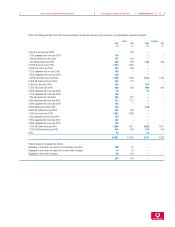

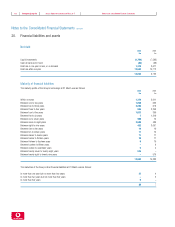

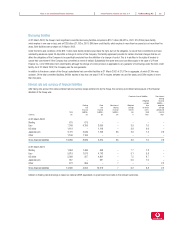

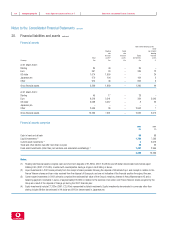

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements106

Notes to the Consolidated Financial Statements continued

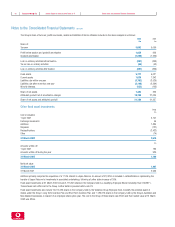

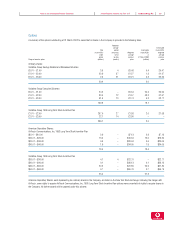

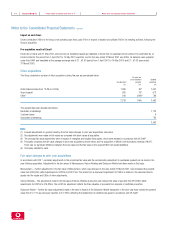

Hedges

The Group’s policy is to use derivative instruments to hedge against exposure to movements in interest rates and exchange rates. Changes in the fair value

of instruments used for hedging are not recognised in the financial statements until the hedged exposure is itself recognised. Unrecognised gains and losses

on instruments used for hedging are set out below:

Total net

Gains Losses gains/(losses)

£m £m £m

Unrecognised gains and losses on hedges at 1 April 2001 6 (5) 1

Less: gains and losses arising in previous years that were recognised in the year (6) 5 (1)

Gains and losses arising before 1 April 2001 that were not recognised at 31 March 2002 –––

Gains and losses arising in the year that were not recognised at 31 March 2002 105 (40) 65

Unrecognised gains and losses on hedges at 31 March 2002 105 (40) 65

Of which:

Gains and losses expected to be recognised in 2002 3 (23) (20)

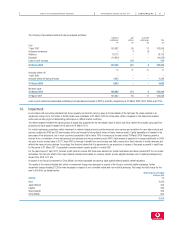

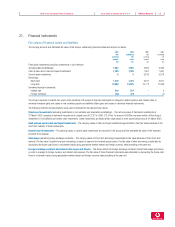

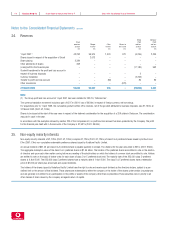

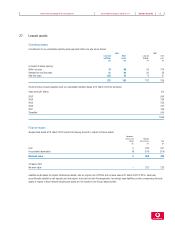

Currency exposures

Taking into account the effect of forward contracts and other derivative instruments, the Group did not have a material financial exposure to foreign exchange

gains or losses on monetary assets and monetary liabilities denominated in foreign currencies at 31 March 2002.

Short-term debtors and creditors have been omitted from the analyses in notes 20 and 21.