Vodafone 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Board’s Report to Shareholders on Directors’ Remuneration Vodafone Group Plc 57Annual Report & Accounts and Form 20-F

Board’s Report to Shareholders on Directors’ Remuneration

Introduction

This report to shareholders is in a number of sections, the first of which deals

with a comprehensive review of remuneration policy and explains the new

arrangements under which the executive directors and senior management of

the Company are to be remunerated in future. The second part describes the

basis of remuneration for the year ended 31 March 2002 and the third

addresses miscellaneous matters such as the basis of appointments and the

remuneration of non-executive directors. The final section sets out in tabular

form the details of the remuneration and share interests of all the directors (and

the senior management as a group) for the year ended 31 March 2002.

The UK Department of Trade and Industry, which issued a consultative document

on directors’ remuneration in 2001, is currently deliberating upon the responses

it has received and your Board, in support of the objective to enhance the

competitiveness of UK companies through improving the linkage between

directors’ pay and performance, hopes that the form and content of this report

will contribute to the attainment of the Government’s objectives and that

excessive prescriptive regulation may be avoided. One of the Government’s

suggestions is that there be an annual advisory vote by shareholders on the

directors’ remuneration report and your Board, as for the past two years, is

putting its future remuneration policy to such a vote at this year’s AGM and will do

so at all subsequent AGMs whenever a significant change to policy is required.

Your Board believes that a properly constituted and effective remuneration

committee is a key to ensuring that executive director remuneration enhances

the competitiveness of a company and it has delegated to the Board’s

Remuneration Committee, which consists only of independent non-executive

directors, the assessment and recommendation of broad policy on executive

remuneration and packages for individual executive directors and certain

matters of administration. The Committee presently comprises Penny Hughes

(Chairman from 1 August 2001), Dr Michael Boskin, Lord MacLaurin, Sir David

Scholey (Chairman until 1 August 2001) and Jürgen Schrempp. Except when his

own remuneration is being discussed, the Chief Executive attends meetings of

the Committee, which also invites the views of the Group Human Resources

Director and seeks advice and commissions reports from expert remuneration

consultants. The Committee meets on at least three occasions each year and,

as this year, more frequently if the need arises.

Remuneration Review and New Policy

At the Annual General Meeting in July 2001, the Chairman advised shareholders

that the Company would conduct a review of its policy on executive directors’

remuneration. The main objectives of the review were to reduce the complexity of

the remuneration package, to improve linkage to business strategy, to increase

the relevance of the pay and performance comparators and to improve the clarity

of the policy.

In the following months, the Company’s Chairman and the Chairman of the

Remuneration Committee carried out an extensive consultation process involving

meetings with many large shareholders and institutional bodies such as the

Association of British Insurers, the National Association of Pension Funds and

Pensions Investment Research Consultants (PIRC). The first meetings were to

understand their views on the previous policy and subsequent meetings were to

seek their comments on the new policy. The responses from these meetings

were overwhelmingly supportive. The Remuneration Committee met frequently to

monitor the progress of this review, consider the input from the consultations and

finally to approve a new policy on remuneration which includes revised long term

incentives for recommendation to the Board. In the development of the new

policy, the Remuneration Committee received advice from Towers Perrin and

Kepler Associates, leading independent remuneration consultants.

The key principles of the new policy, which was required by the Board to

be compliant with the highest standards of UK corporate governance and

which has been developed by the Remuneration Committee on this basis,

are as follows.

•The expected value of total remuneration must be benchmarked against

the relevant market.

•A high proportion of total remuneration is to be delivered through

performance-related remuneration.

•Performance measures must be balanced between absolute financial

measures and sector comparative measures to achieve maximum

alignment between executive and shareholder objectives.

• The majority of performance-related remuneration is to be provided in the

form of equity.

•Share ownership requirements are to be applied to executive directors.

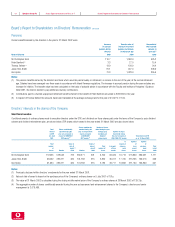

The structure of the main fixed and incentive elements of remuneration under

the new policy and the performance elements on which they are based is

illustrated below:

Base Pay Short/medium

term incentive

Deferred

share bonus

1-year measures

of EBITDA, free

cash flow & ARPU+

2-year measures of

EPS relative to UK RPI

3-year relative TSR for

Performance shares

3-5 year EPS over UK

RPI for options

Performance shares+

share options

Performance ContingentFixed

Circa 20% Circa 80%

Medium/long

term incentive