Vodafone 2002 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

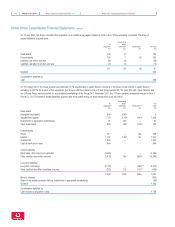

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements114

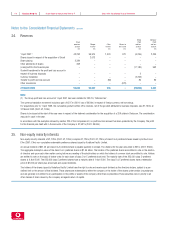

Notes to the Consolidated Financial Statements continued

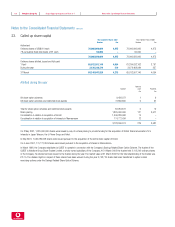

Impact on cash flows

Eircell contributed £163m to the Group’s net operating cash flows, paid £12m in respect of taxation and utilised £102m for investing activities, following the

Group’s acquisition.

Pre-acquisition results of Eircell

Eircell did not trade until 11 May 2001, when eircom plc transferred assets and liabilities to Eircell from its subsidiary Eircell Limited. The profit after tax of

Eircell Limited for the period from 1 April 2001 to 14 May 2001 was £6m, and for the year ended 31 March 2001 was £33m. All balances were prepared

under Irish GAAP and translated at the average exchange rate of £1 : 11.63 (period from 1 April 2001 to 14 May 2001) and £1 : 11.63 (year ended

31 March 2001).

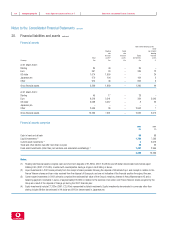

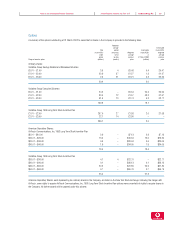

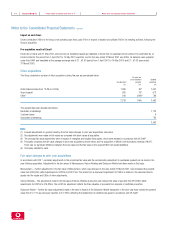

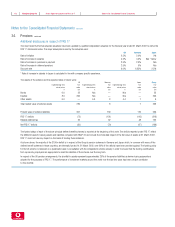

Other acquisitions

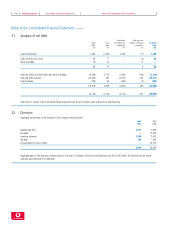

The Group undertook a number of other acquisitions during the year as summarised below: Fair value net

assets/(liabilities) Goodwill

Consideration(5) acquired capitalised

£m £m £m

Airtel (stake increase from 73.8% to 91.6%) 1,086 85(2) 1,001

Grupo Iusacell 692 19(3) 673

Other(1) 540 (248)(4) 788

2,318 (144) 2,462

The goodwill has been allocated as follows:

Subsidiary undertakings 1,724

Customer bases 6

Associated undertakings 732

2,462

Note:

(1) Includes adjustments to goodwill resulting from fair value changes to prior year acquisitions, see below.

(2) No adjustments were made for fair values as compared with book values at acquisition.

(3) The principal fair value adjustments were in respect of intangible and tangible fixed assets, which were restated in accordance with UK GAAP.

(4) Principally comprises the fair value changes to prior year acquisitions shown below, and the acquisition of Mobile Communications Holdings (“MCH”).

There was no significant difference between the book value and the fair value of the acquired MCH net assets/(liabilities).

(5) Principally satisfied by cash.

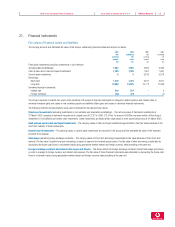

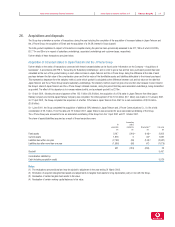

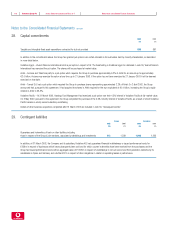

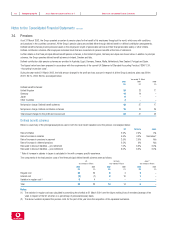

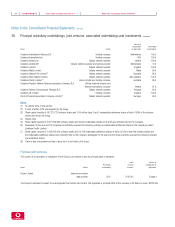

Fair value changes to prior year acquisitions

In accordance with FRS 7, necessary adjustments to the provisional fair value and the corresponding adjustment to purchased goodwill can be made in the

year following acquisition. Adjustments to the fair values of Mannesmann, Verizon Wireless and Swisscom Mobile have been made on this basis.

Mannesmann – Further adjustments to the fair value of Mannesmann, which was disclosed in the year ended 31 March 2001, have increased the goodwill

value from £83,025m (after adjustments for FRS19) to £83,275m. This arises from a downward adjustment of £158m in relation to the value ascribed to

assets held for resale and £86m of other adjustments.

Verizon Wireless – The adjustments made to the fair value of Verizon Wireless during the year reduced the value of goodwill from £19,835m (after

adjustments for FRS19) to £19,825m. The net £10m adjustment reflects the final valuation of proceeds from disposal of conflicted properties.

Swisscom Mobile – Further fair value adjustments made in the year in respect of the Swisscom Mobile transaction in the prior year have revised the goodwill

value from £1,771m as previously reported, to £1,798m, reflecting the restatement of a deferred tax asset in accordance with UK GAAP.