Vodafone 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

Notes to the Consolidated Financial Statements Vodafone Group Plc 89Annual Report & Accounts and Form 20-F

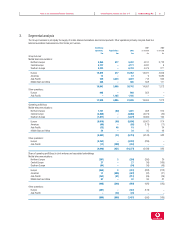

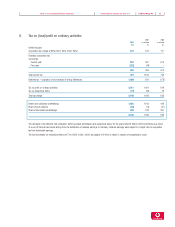

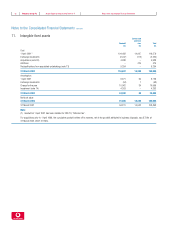

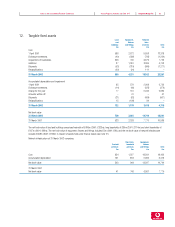

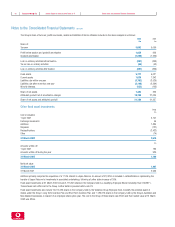

8. Tax on (loss)/profit on ordinary activities

2001 2000

2002 as restated as restated

£m £m £m

United Kingdom

Corporation tax charge at 30% (2001: 30%, 2000: 30%) 187 191 117

Overseas corporation tax

Current tax:

Current year 857 957 675

Prior year (322) (48) –

535 909 675

Total current tax 722 1,100 792

Deferred tax – origination of and reversal of timing differences 1,489 381 (176)

Tax on profit on ordinary activities 2,211 1,481 616

Tax on exceptional items (71) (55) 16

Total tax charge 2,140 1,426 632

Parent and subsidiary undertakings 1,925 1,195 428

Share of joint ventures (23) (12) (57)

Share of associated undertakings 238 243 261

2,140 1,426 632

The decrease in the effective rate of taxation, before goodwill amortisation and exceptional items, for the year ended 31 March 2002 is primarily as a result

of a one off German tax refund arising from the distribution of retained earnings. In Germany, retained earnings were subject to a higher rate of corporation

tax than distributed earnings.

The tax recoverable on exceptional items of £71m (2001: £55m, 2000: tax payable of £16m) is mainly in respect of reorganisation costs.