United Healthcare 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

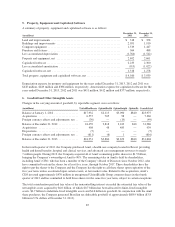

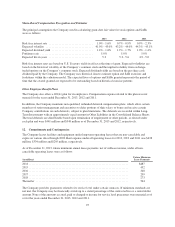

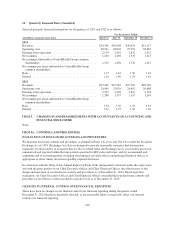

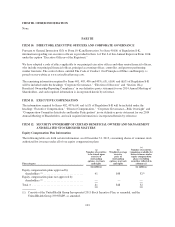

Share-Based Compensation Recognition and Estimates

The principal assumptions the Company used in calculating grant-date fair value for stock options and SARs

were as follows:

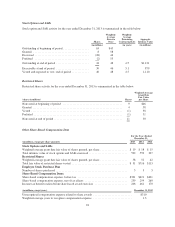

2013 2012 2011

Risk-free interest rate ............................... 1.0% - 1.6% 0.7% - 0.9% 0.9% - 2.3%

Expected volatility ................................. 41.0% - 43.0% 43.2% - 44.0% 44.3% - 45.1%

Expected dividend yield ............................. 1.4% - 1.6% 1.2% - 1.7% 1.0% - 1.4%

Forfeiture rate ..................................... 5.0% 5.0% 5.0%

Expected life in years ............................... 5.3 5.3-5.6 4.9-5.0

Risk-free interest rates are based on U.S. Treasury yields in effect at the time of grant. Expected volatilities are

based on the historical volatility of the Company’s common stock and the implied volatility from exchange-

traded options on the Company’s common stock. Expected dividend yields are based on the per share cash

dividend paid by the Company. The Company uses historical data to estimate option and SAR exercises and

forfeitures within the valuation model. The expected lives of options and SARs granted represents the period of

time that the awards granted are expected to be outstanding based on historical exercise patterns.

Other Employee Benefit Plans

The Company also offers a 401(k) plan for its employees. Compensation expense related to this plan was not

material for the years ended December 31, 2013, 2012 and 2011.

In addition, the Company maintains non-qualified, unfunded deferred compensation plans, which allow certain

members of senior management and executives to defer portions of their salary or bonus and receive certain

Company contributions on such deferrals, subject to plan limitations. The deferrals are recorded within Long-

Term Investments with an approximately equal amount in Other Liabilities in the Consolidated Balance Sheets.

The total deferrals are distributable based upon termination of employment or other periods, as elected under

each plan and were $441 million and $348 million as of December 31, 2013 and 2012, respectively.

12. Commitments and Contingencies

The Company leases facilities and equipment under long-term operating leases that are non-cancelable and

expire on various dates through 2028. Rent expense under all operating leases for 2013, 2012 and 2011 was $438

million, $334 million and $295 million, respectively.

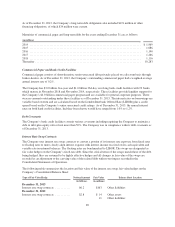

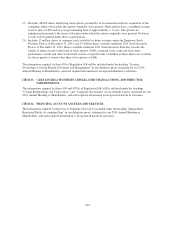

As of December 31, 2013, future minimum annual lease payments, net of sublease income, under all non-

cancelable operating leases were as follows:

(in millions)

Future Minimum

Lease Payments

2014 ...................................................................... $487

2015 ...................................................................... 452

2016 ...................................................................... 348

2017 ...................................................................... 299

2018 ...................................................................... 273

Thereafter ................................................................. 544

The Company provides guarantees related to its service level under certain contracts. If minimum standards are

not met, the Company may be financially at risk up to a stated percentage of the contracted fee or a stated dollar

amount. None of the amounts accrued, paid or charged to income for service level guarantees were material as of

or for the years ended December 31, 2013, 2012 and 2011.

95