United Healthcare 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

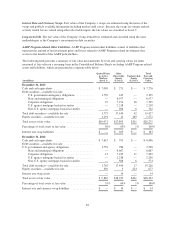

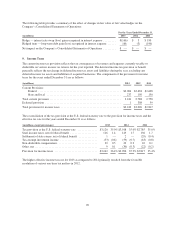

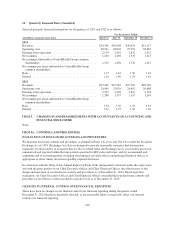

A reconciliation of the beginning and ending amount of unrecognized tax benefits as of December 31 is as

follows:

(in millions) 2013 2012 2011

Gross unrecognized tax benefits, beginning of period ............................... $81 $129 $220

Gross increases:

Current year tax positions ................................................. 8 6 11

Prior year tax positions ................................................... 5 18 10

Gross decreases:

Prior year tax positions ................................................... — (48) (34)

Settlements ............................................................ — (10) (25)

Statute of limitations lapses ............................................... (5) (14) (53)

Gross unrecognized tax benefits, end of period .................................... $89 $ 81 $129

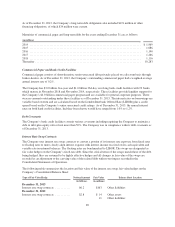

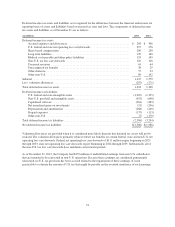

The Company classifies interest and penalties associated with uncertain income tax positions as income taxes

within its Consolidated Financial Statements. During 2013, the Company recognized $4 million of interest

expense. The Company recognized tax benefits from the net reduction of interest and penalties accrued of $20

million and $12 million during the years ended December 31, 2012 and 2011, respectively. The Company had

$27 million and $23 million of accrued interest and penalties for uncertain tax positions as of December 31, 2013

and 2012, respectively. These amounts are not included in the reconciliation above. As of December 31, 2013,

the total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate, was $89

million.

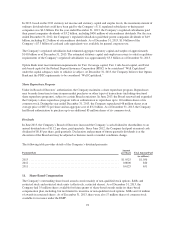

The Company currently files income tax returns in the United States, various states and non-U.S. jurisdictions.

The U.S. Internal Revenue Service (IRS) has completed exams on the consolidated income tax returns for fiscal

years 2012 and prior. The Company’s 2013 tax year is under advance review by the IRS under its Compliance

Assurance Program. With the exception of a few states, the Company is no longer subject to income tax

examinations prior to 2008. The Brazilian federal revenue service—Secretaria da Receita Federal (SRF) may

audit the Company’s Brazilian subsidiaries for a period of five years from the date on which corporate income

taxes should have been paid and/or the date when the tax return was filed. Estimated taxes are paid monthly in

Brazil with an annual return due on June 30 following the end of the taxable year.

The Company believes it is reasonably possible that its liability for unrecognized tax benefits will decrease in the

next twelve months by $33 million as a result of audit settlements and the expiration of statutes of limitations in

certain major jurisdictions.

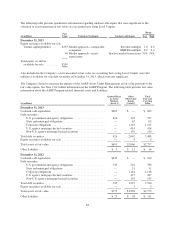

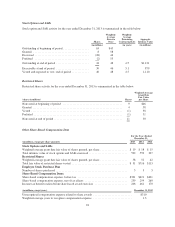

10. Shareholders’ Equity

Regulatory Capital and Dividend Restrictions

The Company’s regulated subsidiaries are subject to regulations and standards in their respective jurisdictions.

These standards, among other things, require these subsidiaries to maintain specified levels of statutory capital,

as defined by each jurisdiction, and restrict the timing and amount of dividends and other distributions that may

be paid to their parent companies. In the United States, most of these regulations and standards are generally

consistent with model regulations established by the National Association of Insurance Commissioners. Except

in the case of extraordinary dividends, these standards generally permit dividends to be paid from statutory

unassigned surplus of the regulated subsidiary and are limited based on the regulated subsidiary’s level of

statutory net income and statutory capital and surplus. These dividends are referred to as “ordinary dividends”

and generally can be paid without prior regulatory approval. If the dividend, together with other dividends paid

within the preceding twelve months, exceeds a specified statutory limit or is paid from sources other than earned

surplus, it is generally considered an “extraordinary dividend” and must receive prior regulatory approval.

92