United Healthcare 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

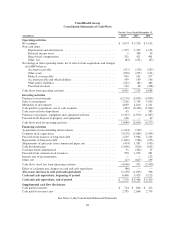

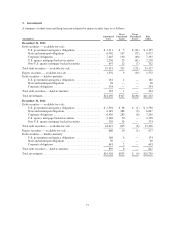

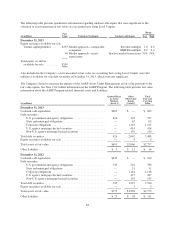

The fair values of the Company’s mortgage-backed securities by credit rating (when multiple credit ratings are

available for an individual security, the average of the available ratings is used) and origination date as of

December 31, 2013 were as follows:

(in millions) AAA AA

Non-Investment

Grade

Total Fair

Value

2013 ................................................... $ 130 $ — $ — $ 130

2012 ................................................... 106 — — 106

2011 ................................................... 20 — — 20

2010 ................................................... 26 — — 26

2009 ................................................... 2 — — 2

2007 ................................................... 63 — 2 65

Pre-2007 ................................................ 340 3 10 353

U.S. agency mortgage-backed securities ....................... 2,218 — — 2,218

Total ................................................... $2,905 $ 3 $ 12 $2,920

The Company includes any securities backed by Alt-A or sub-prime mortgages and any commercial mortgage

loans in default in the non-investment grade column in the table above.

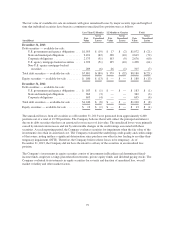

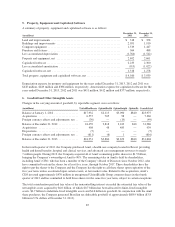

The amortized cost and fair value of available-for-sale debt securities as of December 31, 2013, by contractual

maturity, were as follows:

(in millions)

Amortized

Cost

Fair

Value

Due in one year or less ....................................................... $ 2,042 $ 2,054

Due after one year through five years ........................................... 7,121 7,235

Due after five years through ten years ........................................... 5,164 5,182

Due after ten years .......................................................... 2,051 2,036

U.S. agency mortgage-backed securities ......................................... 2,256 2,218

Non-U.S. agency mortgage-backed securities ..................................... 697 702

Total debt securities — available-for-sale ........................................ $19,331 $19,427

The amortized cost and fair value of held-to-maturity debt securities as of December 31, 2013, by contractual

maturity, were as follows:

(in millions)

Amortized

Cost

Fair

Value

Due in one year or less ......................................................... $ 78 $ 78

Due after one year through five years ............................................. 231 230

Due after five years through ten years ............................................. 154 156

Due after ten years ............................................................ 80 80

Total debt securities — held-to-maturity ........................................... $543 $544

78