United Healthcare 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Delivery System and Payment Modernization. The health care market is changing based on demographic shifts,

new regulations, political forces and both payer and patient expectations. Health plans and care providers are

being called upon to work together to close gaps in care and improve overall care for people, improve the health

of populations and reduce costs. The focus on delivery system modernization and payment reform is critical and

the alignment of incentives between key constituents remains an important theme.

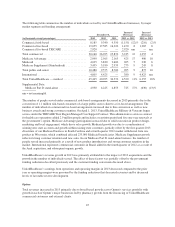

Through expansion of our existing programs and the creation of new programs, we are increasingly rewarding

care providers for delivering improvements in quality and cost-efficiency. As of December 31, 2013, more than

2 million people we serve were directly aligned through the most progressive of these arrangements, including

full risk, shared risk and bundled episode of care payment approaches.

This trend is also creating needs for health management services that can coordinate care around the primary care

physician, including new primary care channels, and for investment in new clinical and administrative

information and management systems, providing growth opportunities for our Optum business platform.

Government Reliance on Private Sector. The government, as a benefit sponsor, has been increasingly relying on

private sector programs. We expect this trend to continue as we believe the private sector provides a more

flexible, better managed, higher quality health care experience than do traditional passive indemnity programs

typically used in governmental benefit programs.

Many states are expanding their interest in managed care with particular emphasis on consumers who have

complex and expensive health care needs. Medicaid managed care is increasingly viewed as an effective method

to improve quality and manage costs. For example, there are nearly 10 million dually eligible beneficiaries who

typically have complex conditions, with costs of care that are far higher than those of a typical Medicare or

Medicaid beneficiary. Similarly, a small but complex group of nearly 4 million individuals who qualify for

additional benefits under LTC programs represent only 6% of the total Medicaid population yet account for more

than 30% of total Medicaid expenditures. The long-term care market represents a portion of the more than

15 million ABD Americans. While these individuals’ health needs are more complex and more costly, they have

primarily been historically served in unmanaged environments. These markets provide UnitedHealthcare and

Optum with an opportunity to work with governments to improve the health status of these populations through

coordination of care. As of December 31, 2013, UnitedHealthcare served more than 275,000 people in legacy

dually eligible programs through Medicare Advantage and SNPs. In the first half of 2014, UnitedHealthcare

Community & State will help implement Integrated MME program awards in three states.

Regulatory Trends and Uncertainties

Following is a summary of management’s view of the trends and uncertainties related to some of the key

provisions of Health Reform Legislation and other regulatory items; for additional information regarding Health

Reform Legislation and regulatory trends and uncertainties, see Item 1, “Business—Government Regulation” and

Item 1A, “Risk Factors.”

Medicare Advantage Rates and Minimum Loss Ratios. Medicare Advantage payment benchmarks have been

cut over the last several years, including 2013, with additional funding reductions to be phased-in through 2017.

Additionally, Congress passed the Budget Control Act of 2011, which as amended by the American Taxpayer

Relief Act of 2012, triggered automatic across-the-board budget cuts (known as sequestration), including a 2%

reduction in Medicare Advantage and Medicare Part D payments beginning April 1, 2013. The CMS final notice

of 2014 Medicare Advantage benchmark rates and payment policies includes significant reductions to 2014

Medicare Advantage payments, including the benchmark reductions described previously. These reductions and

Health Reform Legislation insurance industry tax described below result in revenue reductions and incremental

assessments totaling more than 4% in 2014, against a typical industry forward medical cost trend outlook of 3%.

The impact of these cuts to our Medicare Advantage revenues is partially mitigated by reductions in provider

reimbursements for those care providers with rates indexed to Medicare Advantage revenues or Medicare fee-

for-service reimbursement rates. Compared to 2013, and prior to any efforts to mitigate these funding reductions,

39