United Healthcare 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

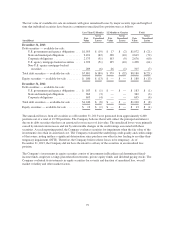

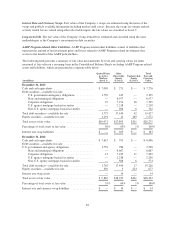

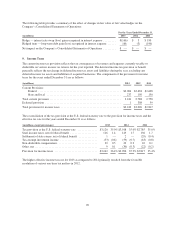

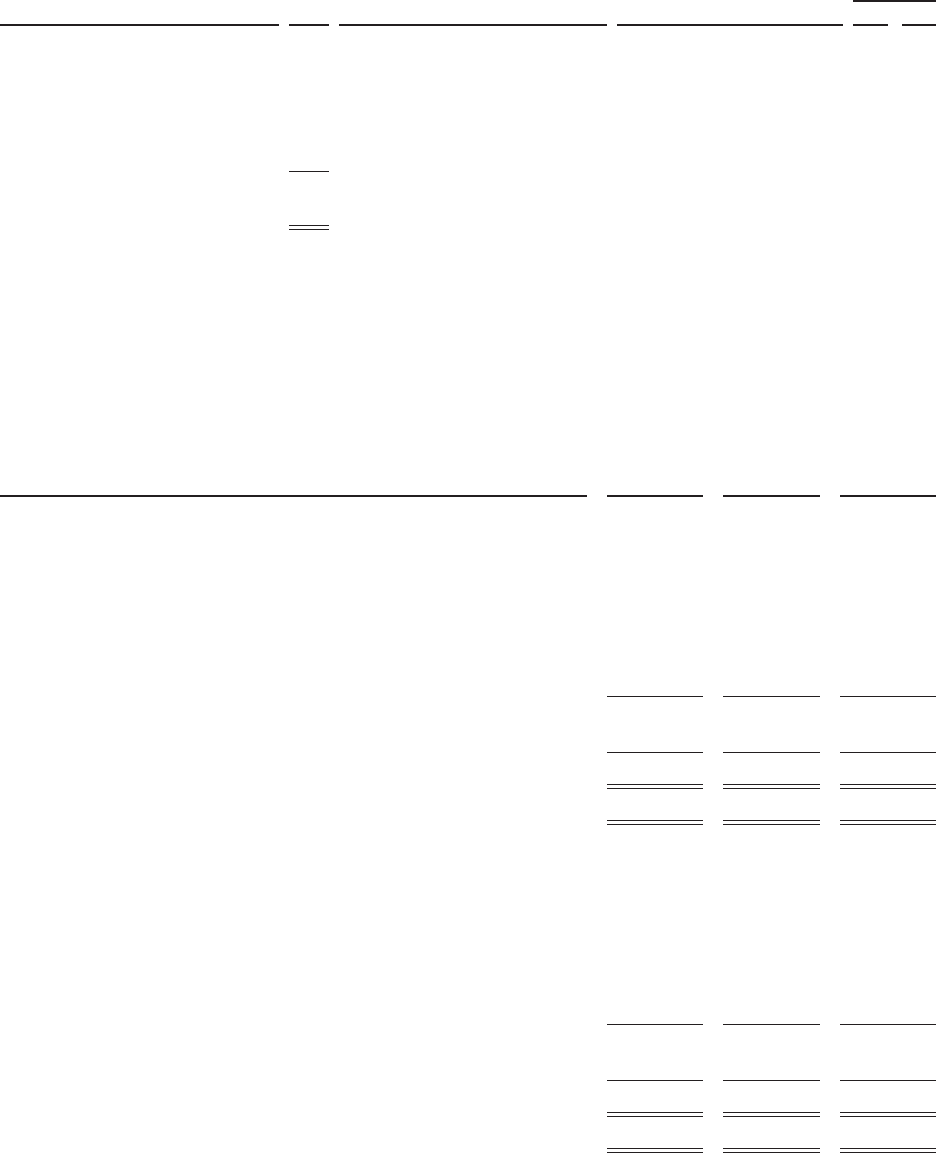

The following table presents quantitative information regarding unobservable inputs that were significant to the

valuation of assets measured at fair value on a recurring basis using Level 3 inputs:

(in millions)

Fair

Value Valuation Technique Unobservable Input

Range

Low High

December 31, 2013

Equity securities-available-for-sale

Venture capital portfolios ...... $233 Market approach - comparable

companies

Revenue multiple

EBITDA multiple

1.0

8.0

6.0

9.0

36 Market approach - recent

transactions

Inactive market transactions N/A N/A

Total equity securities

available-for-sale ........... $269

Also included in the Company’s assets measured at fair value on a recurring basis using Level 3 inputs were $42

million of available-for-sale debt securities at December 31, 2013, which were not significant.

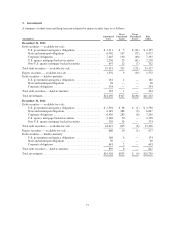

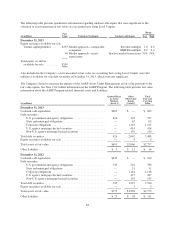

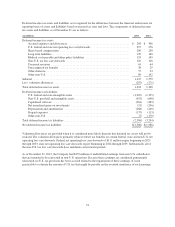

The Company elected to measure the entirety of the AARP Assets Under Management at fair value pursuant to the

fair value option. See Note 2 for further information on the AARP Program. The following table presents fair value

information about the AARP Program-related financial assets and liabilities:

(in millions)

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Total

Fair and

Carrying

Value

December 31, 2013

Cash and cash equivalents ..................................... $265 $ — $ 265

Debt securities:

U.S. government and agency obligations ...................... 426 301 727

State and municipal obligations ............................. — 63 63

Corporate obligations ..................................... — 1,145 1,145

U.S. agency mortgage-backed securities ...................... — 414 414

Non-U.S. agency mortgage-backed securities .................. — 139 139

Total debt securities .......................................... 426 2,062 2,488

Equity securities-available-for-sale .............................. — 4 4

Total assets at fair value ....................................... $691 $2,066 $2,757

Other liabilities .............................................. $ 3 $ 11 $ 14

December 31, 2012

Cash and cash equivalents ..................................... $230 $ — $ 230

Debt securities:

U.S. government and agency obligations ...................... 545 244 789

State and municipal obligations ............................. — 51 51

Corporate obligations ..................................... — 1,118 1,118

U.S. agency mortgage-backed securities ...................... — 427 427

Non-U.S. agency mortgage-backed securities .................. — 155 155

Total debt securities .......................................... 545 1,995 2,540

Equity securities-available-for-sale .............................. — 3 3

Total assets at fair value ....................................... $775 $1,998 $2,773

Other liabilities .............................................. $ 23 $ 58 $ 81

84