United Healthcare 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

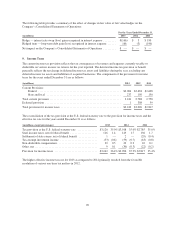

For the years ended December 31, 2013, 2012 and 2011, aggregate consideration paid, net of cash assumed, for

acquisitions other than Amil was $0.4 billion, $3.3 billion and $1.8 billion, respectively. These acquisitions were

not material to the Company’s Consolidated Financial Statements.

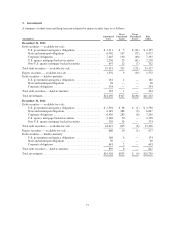

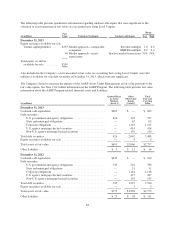

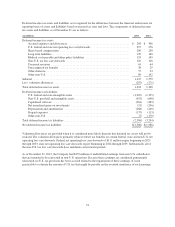

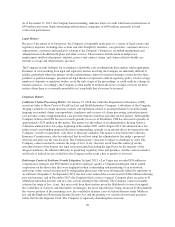

The gross carrying value, accumulated amortization and net carrying value of other intangible assets were as

follows:

December 31, 2013 December 31, 2012

(in millions)

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Customer-related ..................... $4,821 $(2,028) $2,793 $5,229 $(1,629) $3,600

Trademarks and technology ............. 433 (191) 242 445 (146) 299

Trademarks—indefinite-lived ........... 589 — 589 611 — 611

Other ............................... 284 (64) 220 221 (49) 172

Total ............................... $6,127 $(2,283) $3,844 $6,506 $(1,824) $4,682

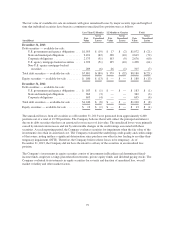

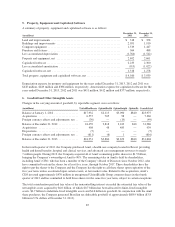

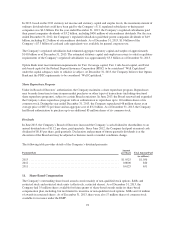

The acquisition date fair values and weighted-average useful lives assigned to finite-lived intangible assets

acquired in business combinations consisted of the following by year of acquisition:

2013 2012

(in millions, except years)

Fair

Value

Weighted-

Average

Useful Life

Fair

Value

Weighted-

Average

Useful Life

Customer-related ............................................ $55 12years $1,530 8 years

Trademarks and technology .................................... 27 12years 79 4 years

Other ...................................................... — 111 15years

Total acquired finite-lived intangible assets ....................... $82 12years $1,720 9 years

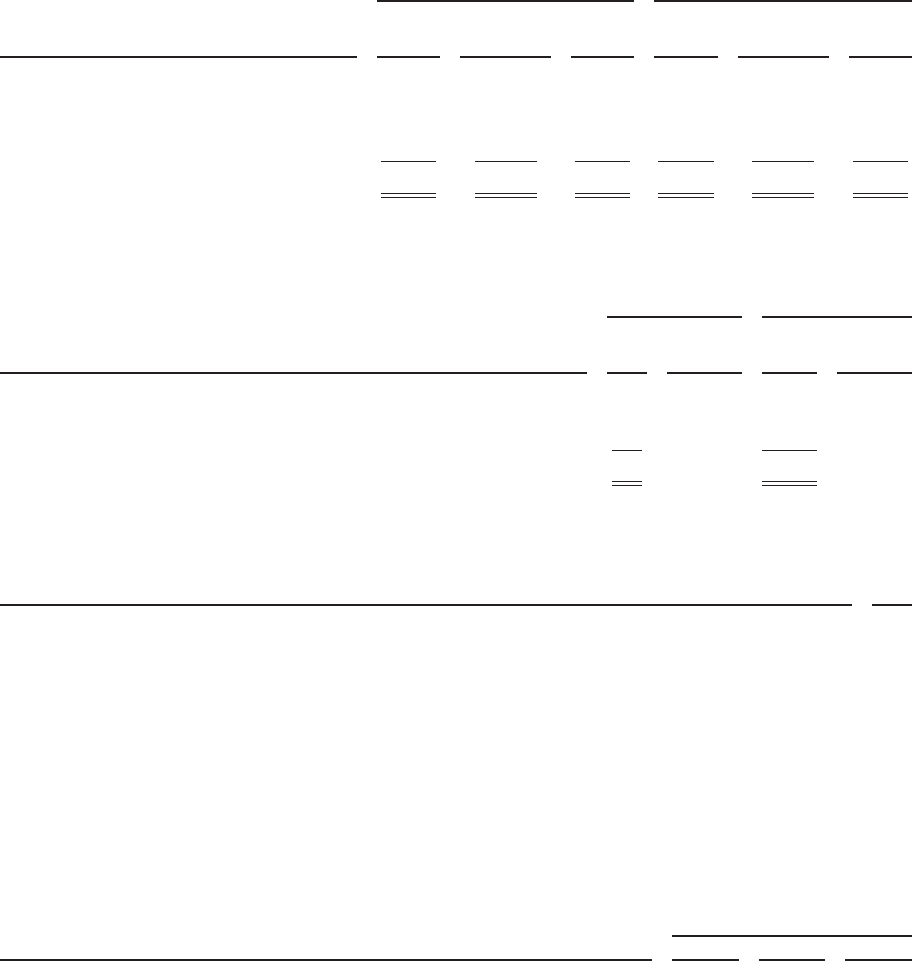

Estimated full year amortization expense relating to intangible assets for each of the next five years ending

December 31 is as follows:

(in millions)

2014 ................................................................................. $500

2015 ................................................................................. 478

2016 ................................................................................. 449

2017 ................................................................................. 411

2018 ................................................................................. 332

Amortization expense relating to intangible assets for 2013, 2012 and 2011 was $519 million, $448 million and

$361 million, respectively.

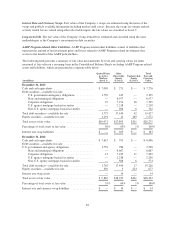

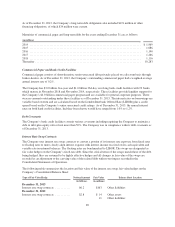

7. Medical Costs and Medical Costs Payable

The following table provides details of the Company’s net favorable medical cost development:

For the Years Ended December 31,

(in millions) 2013 2012 2011

Related to Prior Years ............................................... $680 $860 $720

86