United Healthcare 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

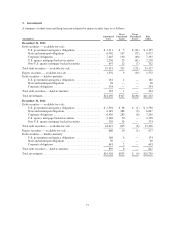

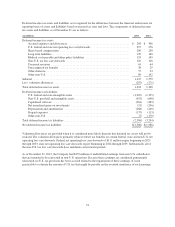

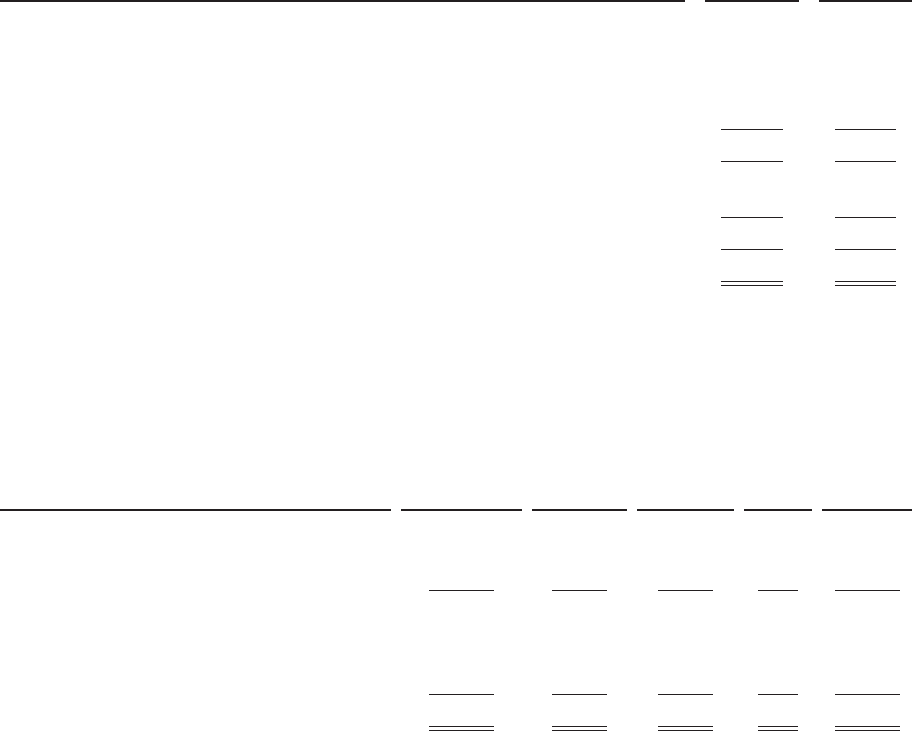

5. Property, Equipment and Capitalized Software

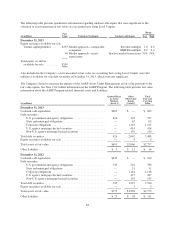

A summary of property, equipment and capitalized software is as follows:

(in millions)

December 31,

2013

December 31,

2012

Land and improvements ................................................. $ 318 $ 358

Buildings and improvements ............................................. 2,051 1,910

Computer equipment ................................................... 1,519 1,447

Furniture and fixtures ................................................... 564 488

Less accumulated depreciation ........................................... (1,760) (1,542)

Property and equipment, net ............................................. 2,692 2,661

Capitalized software .................................................... 2,233 2,300

Less accumulated amortization ........................................... (915) (1,022)

Capitalized software, net ................................................ 1,318 1,278

Total property, equipment and capitalized software, net ........................ $4,010 $ 3,939

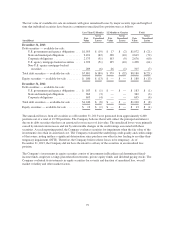

Depreciation expense for property and equipment for the years ended December 31, 2013, 2012 and 2011 was

$445 million, $449 million and $386 million, respectively. Amortization expense for capitalized software for the

years ended December 31, 2013, 2012 and 2011 was $411 million, $412 million and $377 million, respectively.

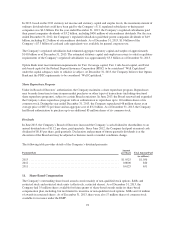

6. Goodwill and Other Intangible Assets

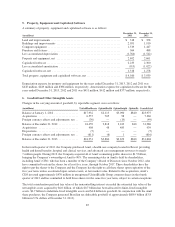

Changes in the carrying amount of goodwill, by reportable segment, were as follows:

(in millions) UnitedHealthcare OptumHealth OptumInsight OptumRx Consolidated

Balance at January 1, 2012 ................. $17,932 $2,113 $3,090 $840 $23,975

Acquisitions ............................ 6,557 705 98 — 7,360

Foreign currency effects and adjustments, net . . (30) — (19) — (49)

Balance at December 31, 2012 .............. 24,459 2,818 3,169 840 31,286

Acquisitions ............................ 408 48 483 — 939

Dispositions ............................. (5) — — — (5)

Foreign currency effects and adjustments, net . . (611) (6) 1 — (616)

Balance at December 31, 2013 .............. $24,251 $2,860 $3,653 $840 $31,604

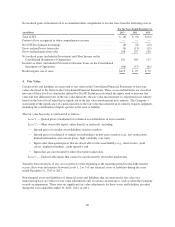

In the fourth quarter of 2012, the Company purchased Amil, a health care company located in Brazil, providing

health and dental benefits, hospital and clinical services, and advanced care management resources to nearly

7 million people. During 2013, the Company acquired all of Amil’s remaining public shares for $1.5 billion,

bringing the Company’s ownership of Amil to 90%. The remaining stake in Amil is held by shareholders,

including Amil’s CEO, who has been a member of the Company’s Board of Directors since October 2012, who

have committed to retain the shares for at least five years, through October 2017. These shareholders have the

right to put the shares to the Company and the Company has the right to call these shares upon expiration of the

five year term, unless accelerated upon certain events, at fair market value. Related to this acquisition, Amil’s

CEO invested approximately $470 million in unregistered UnitedHealth Group common shares in the fourth

quarter of 2012 and has committed to hold those shares for the same five year term, subject to certain exceptions.

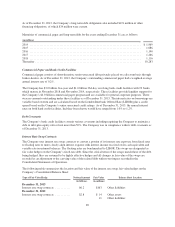

The total consideration paid and fair value of the noncontrolling interest exceeded the estimated fair value of the

net tangible assets acquired by $6.0 billion, of which $0.7 billion has been allocated to finite-lived intangible

assets, $0.7 billion to indefinite-lived intangible assets and $4.6 billion to goodwill. In conjunction with the Amil

share purchases, the Company generated Brazilian tax deductible goodwill of approximately R$8.9 billion ($3.8

billion in U.S. dollars at December 31, 2013).

85