United Healthcare 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UnitedHealth Group

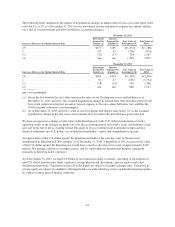

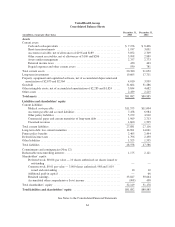

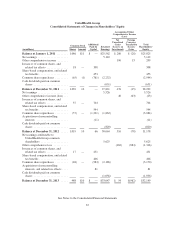

Notes to the Consolidated Financial Statements

1. Description of Business

UnitedHealth Group Incorporated (individually and together with its subsidiaries, “UnitedHealth Group” and

“the Company”) is a diversified health and well-being company dedicated to helping people live healthier lives

and making the health system work better for everyone.

Through the Company’s diversified family of businesses, it leverages core competencies in advanced, enabling

technology; health care data, information and intelligence; and clinical care management and coordination to

help meet the demands of the health system.

2. Basis of Presentation, Use of Estimates and Significant Accounting Policies

Basis of Presentation

The Company has prepared the Consolidated Financial Statements according to U.S. Generally Accepted

Accounting Principles (GAAP) and has included the accounts of UnitedHealth Group and its subsidiaries.

Use of Estimates

These Consolidated Financial Statements include certain amounts based on the Company’s best estimates and

judgments. The Company’s most significant estimates relate to medical costs payable, revenues, valuation and

impairment analysis of goodwill and other intangible assets, estimates of other policy liabilities and other current

receivables, valuations of certain investments, and estimates and judgments related to income taxes and

contingent liabilities. Certain of these estimates require the application of complex assumptions and judgments,

often because they involve matters that are inherently uncertain and will likely change in subsequent periods. The

impact of any changes in estimates is included in earnings in the period in which the estimate is adjusted.

Revenues

Premium revenues are primarily derived from risk-based health insurance arrangements in which the premium is

typically at a fixed rate per individual served for a one-year period, and the Company assumes the economic risk

of funding its customers’ health care and related administrative costs.

Premium revenues are recognized in the period in which eligible individuals are entitled to receive health care

benefits. Health care premium payments received from its customers in advance of the service period are

recorded as unearned revenues. Fully insured commercial products of U.S. health plans, and beginning in 2014,

Medicare Advantage and Medicare Prescription Drug Benefit (Medicare Part D) plans with medical loss ratios as

calculated under the definitions in the Patient Protection and Affordable Care Act and a reconciliation measure,

the Health Care and Education Reconciliation Act of 2010 (together, Health Reform Legislation) and

implementing regulations, that fall below certain targets are required to rebate ratable portions of their premiums

annually. Premium revenues are recognized based on the estimated premiums earned net of projected rebates

because the Company is able to reasonably estimate the ultimate premiums of these contracts. The Company also

records premium revenues from capitation arrangements at its OptumHealth businesses.

The Company’s Medicare Advantage and Medicare Part D premium revenues are subject to periodic adjustment

under the Centers for Medicare and Medicaid Services’ (CMS) risk adjustment payment methodology. CMS

deploys a risk adjustment model that apportions premiums paid to all health plans according to health severity

and certain demographic factors. The CMS risk adjustment model provides higher per member payments for

enrollees diagnosed with certain conditions and lower payments for enrollees who are healthier. Under this risk

adjustment methodology, CMS calculates the risk adjusted premium payment using diagnosis data from hospital

inpatient, hospital outpatient and physician treatment settings. The Company and health care providers collect,

69