United Healthcare 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

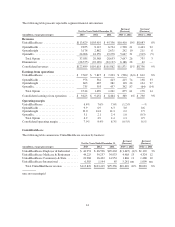

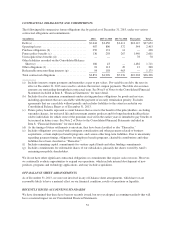

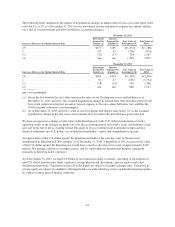

The following table illustrates the sensitivity of these factors and the estimated potential impact on our medical

costs payable estimates for those periods as of December 31, 2013:

Completion Factors

Increase (Decrease) in Factors

Increase (Decrease)

In Medical Costs Payable

(in millions)

(0.75)% ................................................................. $291

(0.50) ................................................................... 194

(0.25) ................................................................... 97

0.25 .................................................................... (96)

0.50 .................................................................... (192)

0.75 .................................................................... (287)

Medical cost PMPM trend factors. Medical cost PMPM trend factors are significant factors we use in

developing our medical costs payable estimates for the most recent three months. Medical cost trend factors are

developed through a comprehensive analysis of claims incurred in prior months, provider contracting and

expected unit costs, benefit design, and by reviewing a broad set of health care utilization indicators including,

but not limited to, pharmacy utilization trends, inpatient hospital census data and incidence data from the

National Centers for Disease Control. We also consider macroeconomic variables such as gross-domestic product

growth, employment and disposable income. A large number of factors can cause the medical cost trend to vary

from our estimates including: our ability and practices to manage medical costs, changes in level and mix of

services utilized, mix of benefits offered including the impact of co-pays and deductibles, changes in medical

practices, catastrophes and epidemics.

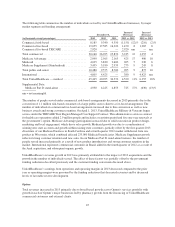

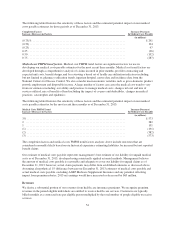

The following table illustrates the sensitivity of these factors and the estimated potential impact on our medical

costs payable estimates for the most recent three months as of December 31, 2013:

Medical Costs PMPM Trend

Increase (Decrease) in Factors

Increase (Decrease)

In Medical Costs Payable

(in millions)

3%..................................................................... $573

2 ...................................................................... 382

1 ...................................................................... 191

(1) ..................................................................... (191)

(2) ..................................................................... (382)

(3) ..................................................................... (573)

The completion factors and medical costs PMPM trend factors analyses above include outcomes that are

considered reasonably likely based on our historical experience estimating liabilities for incurred but not reported

benefit claims.

Our estimate of medical costs payable represents management’s best estimate of our liability for unpaid medical

costs as of December 31, 2013, developed using consistently applied actuarial methods. Management believes

the amount of medical costs payable is reasonable and adequate to cover our liability for unpaid claims as of

December 31, 2013; however, actual claim payments may differ from established estimates as discussed above.

Assuming a hypothetical 1% difference between our December 31, 2013 estimates of medical costs payable and

actual medical costs payable, excluding AARP Medicare Supplement Insurance and any potential offsetting

impact from premium rebates, 2013 net earnings would have increased or decreased by $65 million.

Revenues

We derive a substantial portion of our revenues from health care insurance premiums. We recognize premium

revenues in the period eligible individuals are entitled to receive health care services. Customers are typically

billed monthly at a contracted rate per eligible person multiplied by the total number of people eligible to receive

services.

54