United Healthcare 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

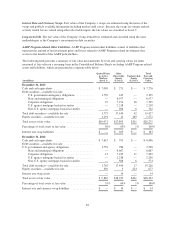

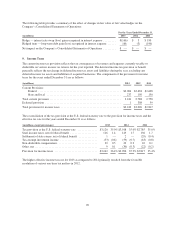

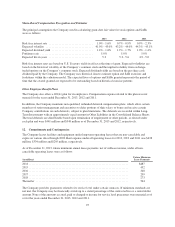

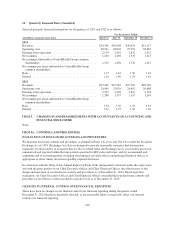

Deferred income tax assets and liabilities are recognized for the differences between the financial and income tax

reporting bases of assets and liabilities based on enacted tax rates and laws. The components of deferred income

tax assets and liabilities as of December 31 are as follows:

(in millions) 2013 2012

Deferred income tax assets:

Accrued expenses and allowances ........................................... $ 284 $ 306

U.S. federal and state net operating loss carryforwards ........................... 257 276

Share-based compensation ................................................. 200 238

Long-term liabilities ...................................................... 170 160

Medical costs payable and other policy liabilities ............................... 155 149

Non-U.S. tax loss carryforwards ............................................ 110 126

Unearned revenues ....................................................... 65 64

Unrecognized tax benefits ................................................. 38 25

Other-domestic .......................................................... 57 93

Other-non-U.S. .......................................................... 89 142

Subtotal .................................................................... 1,425 1,579

Less: valuation allowances ..................................................... (207) (271)

Total deferred income tax assets ................................................ 1,218 1,308

Deferred income tax liabilities:

U.S. federal and state intangible assets ....................................... (1,207) (1,335)

Non-U.S. goodwill and intangible assets ...................................... (453) (640)

Capitalized software ...................................................... (481) (482)

Net unrealized gains on investments ......................................... (31) (296)

Depreciation and amortization .............................................. (268) (249)

Prepaid expenses ......................................................... (137) (113)

Other-non-U.S. .......................................................... (7) (179)

Total deferred income tax liabilities .............................................. (2,584) (3,294)

Net deferred income tax liabilities ............................................... $(1,366) $(1,986)

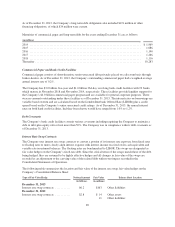

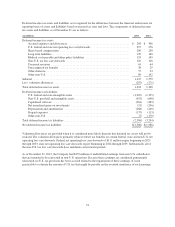

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will not be

realized. The valuation allowances primarily relate to future tax benefits on certain federal, state and non-U.S. net

operating loss carryforwards. Federal net operating loss carryforwards of $111 million expire beginning in 2021

through 2033, state net operating loss carryforwards expire beginning in 2014 through 2033. Substantially all of

the non-U.S. tax loss carryforwards have indefinite carryforward periods.

As of December 31, 2013, the Company had $359 million of undistributed earnings from non-U.S. subsidiaries

that are intended to be reinvested in non-U.S. operations. Because these earnings are considered permanently

reinvested, no U.S. tax provision has been accrued related to the repatriation of these earnings. It is not

practicable to estimate the amount of U.S. tax that might be payable on the eventual remittance of such earnings.

91