United Healthcare 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commercial Paper and Bank Credit Facility

Commercial paper consists of senior unsecured debt sold on a discount basis with maturities up to 270 days. As

of December 31, 2010, the Company’s outstanding commercial paper had a weighted-average annual interest rate

of 0.4%.

The Company has a $2.5 billion five-year revolving bank credit facility with 23 banks, which matures in May

2012. This facility supports the Company’s commercial paper program and is available for general corporate

purposes. There were no amounts outstanding under this facility as of December 31, 2010. The interest rate is

variable based on term and amount and is calculated based on the London Interbank Offered Rate (LIBOR) plus

a spread. As of December 31, 2010, the annual interest rate on this facility, had it been drawn, would have ranged

from 0.5% to 0.7%.

Debt Covenants

The Company’s bank credit facility contains various covenants including requiring the Company to maintain a

debt-to-total-capital ratio, calculated as debt divided by the sum of debt and shareholders’ equity, below 50%.

The Company was in compliance with its debt covenants as of December 31, 2010.

Long-Term Debt

In October 2010, the Company issued $750 million in senior unsecured notes under its February 2008 S-3

shelf registration statement. The issuance included $450 million of 3.875% fixed-rate notes due October 2020

and $300 million of 5.700% fixed-rate notes due October 2040.

In February 2010, the Company completed cash tender offers for $775 million in aggregate principal of certain of

its outstanding fixed-rate notes to improve the matching of interest rate exposure related to its floating rate assets

and liabilities on its balance sheet.

In February 2008, the Company issued a total of $3.0 billion in senior unsecured debt, which included: $250

million of floating-rate notes due February 2011, $550 million of 4.9% fixed-rate notes due February 2013, $1.1

billion of 6.0% fixed-rate notes due February 2018 and $1.1 billion of 6.9% fixed-rate notes due February 2038.

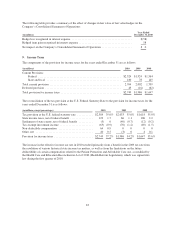

Interest Rate Swap Contracts

During 2010, the Company entered into interest rate swap contracts to convert a portion of its interest rate

exposure from fixed rates to floating rates to more closely align interest expense with interest income received on

its cash equivalent and investment balances. The floating rates are benchmarked to LIBOR. The swaps are

designated as fair value hedges on fixed-rate debt issues maturing between March 2011 through March 2016 and

June 2017 through October 2020. Since the specific terms and notional amounts of the swaps match those of the

debt being hedged, they were assumed to be highly effective hedges and all changes in fair value of the swaps

were recorded on the Consolidated Balance Sheets with no net impact recorded in the Consolidated Statements of

Operations.

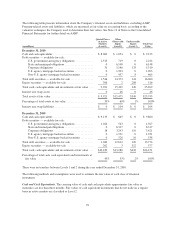

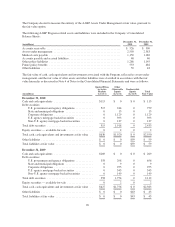

The following table summarizes the location and fair value of fair value hedges on the Company’s Consolidated

Balance Sheet as of December 31, 2010:

Notional Amount Balance Sheet Location Fair Value

(in millions) (in millions)

$ 5,725 Other assets ........................ $46

Other liabilities ..................... 104

82