United Healthcare 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

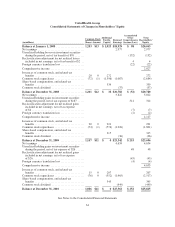

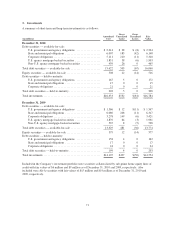

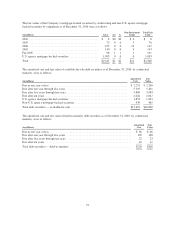

3. Investments

A summary of short-term and long-term investments is as follows:

(in millions)

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

December 31, 2010

Debt securities — available-for-sale:

U.S. government and agency obligations ................. $ 2,214 $ 28 $ (8) $ 2,234

State and municipal obligations ......................... 6,007 183 (42) 6,148

Corporate obligations ................................. 5,111 210 (11) 5,310

U.S. agency mortgage-backed securities .................. 1,851 58 (6) 1,903

Non-U.S. agency mortgage-backed securities .............. 439 26 0 465

Total debt securities — available-for-sale ..................... 15,622 505 (67) 16,060

Equity securities — available-for-sale ........................ 508 22 (14) 516

Debt securities — held-to-maturity:

U.S. government and agency obligations ................. 167 5 0 172

State and municipal obligations ......................... 15 0 0 15

Corporate obligations ................................. 21 0 0 21

Total debt securities — held-to-maturity ...................... 203 5 0 208

Total investments ........................................ $16,333 $532 $(81) $16,784

December 31, 2009

Debt securities — available-for-sale:

U.S. government and agency obligations ................. $ 1,566 $ 12 $(11) $ 1,567

State and municipal obligations ......................... 6,080 248 (11) 6,317

Corporate obligations ................................. 3,278 149 (6) 3,421

U.S. agency mortgage-backed securities .................. 1,870 64 (3) 1,931

Non-U.S. agency mortgage-backed securities .............. 535 8 (5) 538

Total debt securities — available-for-sale ..................... 13,329 481 (36) 13,774

Equity securities — available-for-sale ........................ 579 12 (14) 577

Debt securities — held-to-maturity:

U.S. government and agency obligations ................. 158 4 0 162

State and municipal obligations ......................... 17 0 0 17

Corporate obligations ................................. 24 0 0 24

Total debt securities — held-to-maturity ...................... 199 4 0 203

Total investments ........................................ $14,107 $497 $(50) $14,554

Included in the Company’s investment portfolio were securities collateralized by sub-prime home equity lines of

credit with fair values of $6 million and $9 million as of December 31, 2010 and 2009, respectively. Also

included were Alt-A securities with fair values of $15 million and $19 million as of December 31, 2010 and

2009, respectively.

71