United Healthcare 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Debt Tender. In February 2010, we completed cash tender offers for $775 million aggregate principal amount of

certain of our outstanding notes. We believe this debt repurchase will improve the matching of floating rate

assets and liabilities on our balance sheet and reduce our debt service cost. We used cash on hand to fund the

purchase of the notes.

Dividends. In May 2010, our Board of Directors increased our cash dividend to shareholders and moved us to a

quarterly dividend payment cycle. Declaration and payment of future quarterly dividends are at the discretion of

the Board and may be adjusted as business needs or market conditions change. Prior to May 2010, our policy had

been to pay an annual dividend.

The following table provides details of our dividend payments:

Year

Aggregate

Amount per Share Total Amount Paid

(in millions)

2008 ......................................................... $0.030 $ 37

2009 ......................................................... 0.030 36

2010 ......................................................... 0.405 449

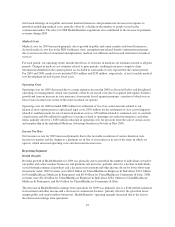

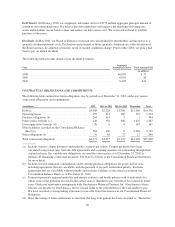

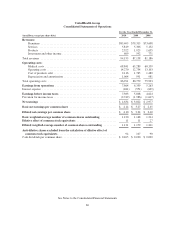

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

The following table summarizes future obligations due by period as of December 31, 2010, under our various

contractual obligations and commitments:

(in millions) 2011 2012 to 2013 2014 to 2015 Thereafter Total

Debt (a) ...................................... $3,008 $2,228 $1,780 $11,360 $18,376

Operating leases ............................... 259 431 285 579 1,554

Purchase obligations (b) ......................... 264 114 5 1 384

Future policy benefits (c) ........................ 126 356 380 1,625 2,487

Unrecognized tax benefits (d) .................... 20 0 0 147 167

Other liabilities recorded on the Consolidated Balance

Sheet (e) ................................... 364 100 0 2,268 2,732

Other obligations (f) ............................ 76 88 72 12 248

Total contractual obligations ..................... $4,117 $3,317 $2,522 $15,992 $25,948

(a) Includes interest coupon payments and maturities at par or put values. Coupon payments have been

calculated using stated rates from the debt agreements and assuming amounts are outstanding through their

contractual term. For variable-rate obligations, we used the rates in place as of December 31, 2010 to

estimate all remaining contractual payments. See Note 8 of Notes to the Consolidated Financial Statements

for more detail.

(b) Includes fixed or minimum commitments under existing purchase obligations for goods and services,

including agreements that are cancelable with the payment of an early termination penalty. Excludes

agreements that are cancelable without penalty and excludes liabilities to the extent recorded in our

Consolidated Balance Sheets as of December 31, 2010.

(c) Estimated payments required under life and annuity contracts and health policies sold to individuals for

which some of the premium received in the earlier years is intended to pay benefits to be incurred in future

years. Under our reinsurance arrangement with OneAmerica Financial Partners, Inc. (OneAmerica) these

amounts are payable by OneAmerica, but we remain liable to the policyholders if they are unable to pay.

We have recorded a corresponding reinsurance receivable from OneAmerica in our Consolidated Financial

Statements.

(d) Since the timing of future settlements is uncertain, the long-term portion has been classified as “Thereafter.”

50