United Healthcare 2010 Annual Report Download - page 67

Download and view the complete annual report

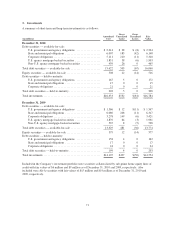

Please find page 67 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash, Cash Equivalents and Investments

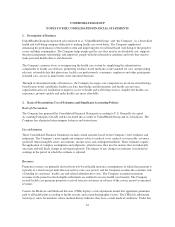

Cash and cash equivalents are highly liquid investments that have an original maturity of three months or less.

The fair value of cash and cash equivalents approximates their carrying value because of the short maturity of the

instruments.

The Company had checks outstanding in excess of bank deposits of $1.3 billion as of December 31, 2010 and

$1.2 billion as of December 31, 2009, which were classified as Accounts Payable and Accrued Liabilities in the

Consolidated Balance Sheets and the changes have been reflected as Checks Outstanding within financing

activities in the Consolidated Statements of Cash Flows.

Investments with maturities of less than one year are classified as short-term. Because of regulatory

requirements, certain investments are included in long-term investments regardless of their maturity date. The

Company classifies these investments as held-to-maturity and reports them at amortized cost. Substantially all

other investments are classified as available-for-sale and reported at fair value based on quoted market prices,

where available.

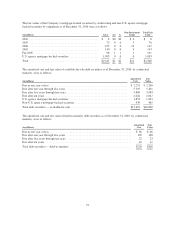

The Company excludes unrealized gains and losses on investments in available-for-sale securities from earnings

and reports them, net of income tax effects, as a separate component of shareholders’ equity. The Company

evaluates investments for impairment by considering the length of time and extent to which market value has

been less than cost, the financial condition and near-term prospects of the issuer as well as specific events or

circumstances that may influence the operations of the issuer and the Company’s intent to sell the security or the

likelihood that it will be required to sell the security before recovery of the entire amortized cost. For debt

securities, if the Company intends to either sell or determines that it will be more likely than not be required to

sell a security before recovery of the entire amortized cost basis or maturity of the security, the Company

recognizes the entire impairment in earnings. If the Company does not intend to sell the debt security and it

determines that it will not be more likely than not be required to sell the security but it does not expect to recover

the entire amortized cost basis, the impairment is bifurcated into the amount attributed to the credit loss, which is

recognized in earnings, and all other causes, which are recognized in other comprehensive income. For equity

securities, the Company recognizes impairments in other comprehensive income if it expects to hold the security

until fair value increases to at least the security’s cost basis and it expects that increase in fair value to occur in a

reasonably forecasted period. If the Company intends to sell the equity security or if it believes that recovery of

fair value to cost will not occur in a reasonably forecasted period, the Company recognizes the impairment in net

earnings. New information and the passage of time can change these judgments. The Company manages its

investment portfolio to limit its exposure to any one issuer or market sector, and largely limits its investments to

U.S. government and agency securities; state and municipal securities; mortgage-backed securities; and corporate

debt obligations, substantially all of investment grade quality. Securities downgraded below policy minimums

after purchase will be disposed of in accordance with the investment policy. To calculate realized gains and

losses on the sale of investments, the Company uses the specific cost or amortized cost of each investment sold.

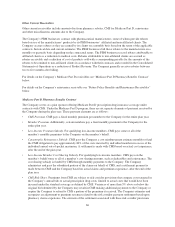

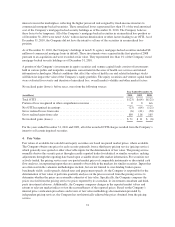

Assets Under Management

The Company administers certain aspects of AARP’s insurance program (see Note 12 of Notes to the

Consolidated Financial Statements). Pursuant to the Company’s agreement, AARP assets are managed separately

from its general investment portfolio and are used to pay costs associated with the AARP program. These assets

are invested at the Company’s discretion, within investment guidelines approved by AARP. The Company does

not guarantee any rates of return on these investments and, upon transfer of the AARP contract to another entity,

the Company would transfer cash equal in amount to the fair value of these investments at the date of transfer to

that entity. Because the purpose of these assets is to fund the medical costs payable, the rate stabilization fund

(RSF) liabilities and other related liabilities associated with the AARP contract, assets under management are

classified as current assets, consistent with the classification of these liabilities. Interest earnings and realized

investment gains and losses on these assets accrue to the overall benefit of the AARP policyholders through the

RSF. Accordingly, they are not included in the Company’s earnings.

65