United Healthcare 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OptumHealth

Increased OptumHealth revenues for 2009 were primarily driven by new business development in large-scale

public sector care and behavioral health programs for state clients, which were partially offset by a decline in

individuals served through commercial products.

Earnings from operations and operating margins for 2009 decreased due to the decrease in commercial

membership described above, start-up costs for new large contracts and lower investment income, partially offset

by earnings growth from expanding services in the public sector and disciplined operating cost management.

Ingenix

Improvements in Ingenix revenues and earnings from operations for 2009 were primarily due to the impact of

improved performance in the payer business, new internal service offerings and the effect of 2009 acquisitions.

The decreases in operating margins for 2009 were primarily due to investments in services offerings, including

outsourcing services for pharmaceutical customers and costs for international expansion, hospital revenue cycle

management and data privacy and security.

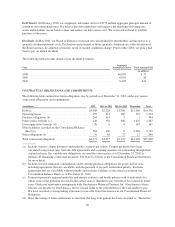

Prescription Solutions

The increased Prescription Solutions revenues for 2009 were primarily due to growth in customers served

through Medicare Part D prescription drug plans by our UnitedHealthcare Medicare & Retirement business,

which is the largest customer of this reporting segment. Intersegment revenues eliminated in consolidation were

$12.6 billion and $11.0 billion for 2009 and 2008, respectively.

Prescription Solutions earnings from operations for 2009 increased primarily due to prescription volume growth,

strong success under performance-based purchasing arrangements, gains in mail service drug fulfillment and a

continuing favorable mix shift to generic pharmaceuticals.

LIQUIDITY, FINANCIAL CONDITION AND CAPITAL RESOURCES

Liquidity

Introduction

We manage our liquidity and financial position in the context of our overall business strategy. We continually

forecast and manage our cash, investments, working capital balances and capital structure to meet the short- and

long-term obligations of our businesses while maintaining liquidity and financial flexibility. Cash flows

generated from operating activities are principally from earnings before non-cash expenses. The risk of decreased

operating cash flow from a decline in earnings is partially mitigated by the diversity of our businesses,

geographies and customers; our disciplined underwriting and pricing processes for our risk-based businesses; and

continued productivity improvements in our operating costs.

Our regulated subsidiaries generate significant cash flows from operations. A majority of the assets held by our

regulated subsidiaries are in the form of cash, cash equivalents and investments. After considering expected cash

flows from operating activities, we generally invest cash of regulated subsidiaries that exceeds our expected

short-term obligations in longer term, liquid, investment-grade, debt securities to improve our overall investment

return. We make these investments pursuant to our Board of Directors’ approved investment policy, which

focuses on preservation of capital, credit quality, diversification, income and duration. The policy also generally

governs return objectives, regulatory limitations, tax implications and risk tolerances.

Our regulated subsidiaries are subject to regulations and standards in their respective states of domicile. Most of

these regulations and standards conform to those established by the NAIC. These standards, among other things,

require these subsidiaries to maintain specified levels of statutory capital, as defined by each state, and restrict

the timing and amount of dividends and other distributions that may be paid to their parent companies. Except in

46