United Healthcare 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

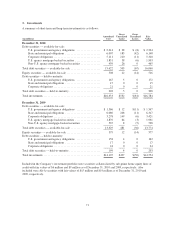

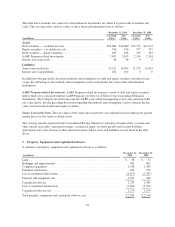

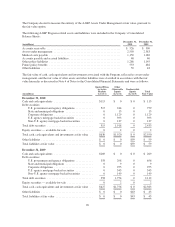

8. Commercial Paper and Long-Term Debt

Commercial paper and long-term debt consisted of the following:

December 31, 2010 December 31, 2009

(in millions)

Par

Value

Carrying

Value

Fair

Value

Par

Value

Carrying

Value

Fair

Value

Commercial paper ................................ $ 930 $ 930 $ 930 $ 0 $ 0 $ 0

Senior unsecured floating-rate notes due June 2010 ......000500500499

5.1% senior unsecured notes due November 2010 .......000250257259

Senior unsecured floating-rate notes due February 2011 . . 250 250 250 250 250 251

5.3% senior unsecured notes due March 2011 .......... 705 712 711 750 781 777

5.5% senior unsecured notes due November 2012 ....... 352 372 377 450 480 481

4.9% senior unsecured notes due February 2013 ........ 534 541 568 550 549 575

4.9% senior unsecured notes due April 2013 ........... 409 425 437 450 464 472

4.8% senior unsecured notes due February 2014 ........ 172 186 184 250 268 256

5.0% senior unsecured notes due August 2014 .......... 389 425 423 500 540 518

4.9% senior unsecured notes due March 2015 .......... 416 456 444 500 544 513

5.4% senior unsecured notes due March 2016 .......... 601 666 661 750 847 772

5.4% senior unsecured notes due November 2016 ....... 95 95 105 95 95 98

6.0% senior unsecured notes due June 2017 ............ 441 484 491 500 587 523

6.0% senior unsecured notes due November 2017 ....... 156 167 174 250 285 258

6.0% senior unsecured notes due February 2018 ........ 1,100 1,065 1,249 1,100 1,099 1,136

3.9% senior unsecured notes due October 2020 ......... 450 413 429000

Zero coupon senior unsecured notes due November

2022 ......................................... 1,095 588 677 1,095 558 611

5.8% senior unsecured notes due March 2036 .......... 850 844 862 850 844 762

6.5% senior unsecured notes due June 2037 ............ 500 495 552 500 495 493

6.6% senior unsecured notes due November 2037 ....... 650 645 729 650 645 651

6.9% senior unsecured notes due February 2038 ........ 1,100 1,085 1,281 1,100 1,085 1,138

5.7% senior unsecured notes due October 2040 ......... 300 298 299000

Total commercial paper and long-term debt ............ $11,495 $11,142 $11,833 $11,340 $11,173 $11,043

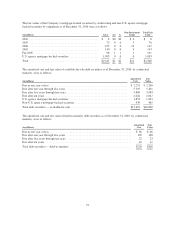

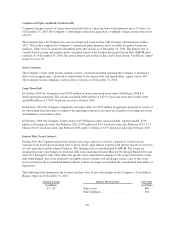

Maturities of commercial paper and long-term debt for the years ending December 31 are as follows:

(in millions)

Maturities of

Long-Term Debt

2011 ......................................................................... $1,892

2012 ......................................................................... 372

2013 ......................................................................... 966

2014 ......................................................................... 611

2015 ......................................................................... 456

Thereafter ..................................................................... 6,257

$1,095 million par, zero coupon senior unsecured notes due November 2022 (a) ............. 588

(a) These notes have been included in current maturities of long-term debt in the Consolidated Balance Sheets

as of December 31, 2010 and 2009 due to a current note holder option to “put” the note to the Company

which began on November 15, 2010, and recurs each November 15 thereafter until 2022 (except 2014), at

accreted value.

81