United Healthcare 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The risk-free interest rate is based on U.S. Treasury yields in effect at the time of grant. Expected volatilities are

based on a blend of the implied volatilities from traded options on our common stock and the historical volatility

of our common stock. We use historical data to estimate option and SAR exercises and employee terminations

within the valuation model. The expected term of options and SARs granted represents the period of time that the

awards granted are expected to be outstanding based on historical exercise patterns.

The weighted-average fair value of stock options and SARs granted was $11 per share, $14 per share and $12 per

share for 2006, 2005 and 2004, respectively. The aggregate fair value of stock options and SARs that vested

during 2006, 2005 and 2004 was $371 million, $350 million and $322 million, respectively. As of December 31,

2006, the aggregate intrinsic value of outstanding stock options and SARs was $4.6 billion, with a weighted-

average remaining contractual term of 6.0 years. The aggregate intrinsic value of exercisable stock options and

SARs at that same date was $4.0 billion, with a weighted-average remaining contractual term of 4.8 years. The

total intrinsic value of options and SARs exercised during 2006, 2005 and 2004 was $753 million, $847 million

and $951 million, respectively.

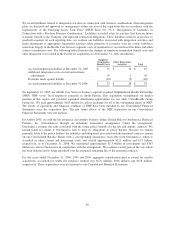

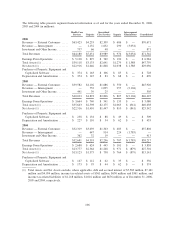

Restricted stock awards generally vest ratably over two to four years. Compensation expense related to restricted

stock awards is determined based upon the fair value of each award on the date of grant. Restricted stock award

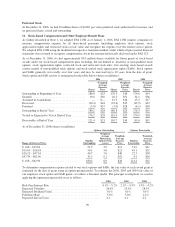

activity is summarized in the table below (shares in millions):

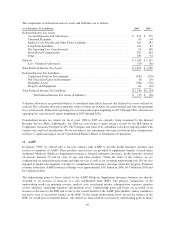

2006 2005 2004

Shares

Weighted-

Average

Grant Date

Fair Value Shares

Weighted-

Average

Grant Date

Fair Value Shares

Weighted-

Average

Grant Date

Fair Value

Outstanding at Beginning of Year .............. 1.8 $58 0.6 $31 0.1 $21

Granted ................................... 0.1 $56 1.4 $62 0.5 $33

Vested .................................... (0.6) $57 (0.2) $31 — $21

Outstanding at End of Year ................... 1.3 $59 1.8 $58 0.6 $31

We recognize compensation cost for stock-based awards, including stock options, SARs, restricted stock and

restricted stock units, on a straight-line basis over the related service period (generally the vesting period) of the

award, or to an employee’s eligible retirement date under the award agreement, if earlier. For 2006, 2005 and

2004, we recognized compensation expense related to our stock-based compensation plans of $404 million ($259

million net of tax effects), $306 million ($194 million net of tax effects) and $244 million ($155 million net of

tax effects), respectively. Stock-based compensation expense is recognized within Operating Costs in the

Consolidated Statements of Operations. Stock compensation expense for 2006 included $31 million associated

with the cash settlement of stock options expiring or forfeiting during the period. Our registration statement,

which covers issuances of common stock upon stock option exercise, was unavailable as a result of the

determination that our historical financial statements should no longer be relied upon. As of December 31, 2006,

there was $634 million of total unrecognized compensation cost related to stock awards that is expected to be

recognized as an expense over a weighted-average period of approximately 1.4 years.

For 2006, 2005 and 2004, the income tax benefit realized from stock-based awards was $287 million, $311

million and $304 million, respectively.

In November and December 2006, 15 executives of the Company entered into options repricing agreements with

the Company to ensure that there was no potential for financial gain from the incorrect dating of any option the

executives had received in light of the conclusions of the WilmerHale Report, as well as to avoid potential

additional surtax liability under Section 409A of the Internal Revenue Code (Section 409A). These repricings

increased the exercise prices of certain awards to either the highest closing price of the stated grant year or to the

closing price of the Company’s common stock on the accounting measurement date. There was no incremental

fair value associated with these modifications.

97