United Healthcare 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

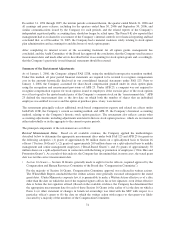

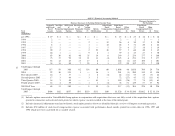

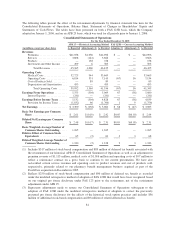

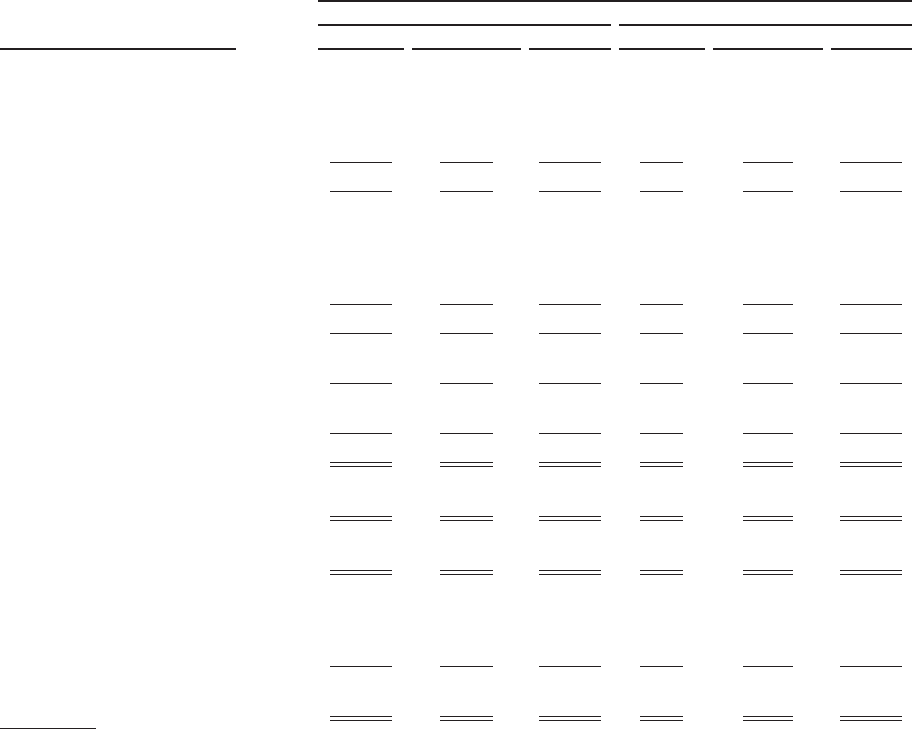

The following tables present the effect of the restatement adjustments by financial statement line item for the

Consolidated Statements of Operations, Balance Sheet, Statement of Changes in Shareholders’ Equity and

Statements of Cash Flows. The tables have been presented on both a FAS 123R basis, which the Company

adopted on January 1, 2006, and on an APB 25 basis, which was used for all periods prior to January 1, 2006.

Consolidated Statements of Operations

For the Year Ended December 31, 2005

APB 25 — Historical Accounting Method FAS 123R — Current Accounting Method

(in millions, except per share data) As Reported Adjustments (1) As Restated Adoption (2) Adjustments (3) As Restated

Revenues

Premiums .................... $41,058 $1,038 $42,096 $ — $ — $42,096

Services ..................... 3,808 (142) 3,666 — — 3,666

Products ..................... — 158 158 — — 158

Investment and Other Income .... 499 6 505 — — 505

TotalRevenues............ 45,365 1,060 46,425 — — 46,425

Operating Costs

Medical Costs ................. 32,725 944 33,669 — — 33,669

Operating Costs ............... 6,814 331 7,145 (67) 56 7,134

CostofProductsSold........... — 89 89 — — 89

Depreciation and Amortization . . . 453 — 453 — — 453

Total Operating Costs . . . . . . 39,992 1,364 41,356 (67) 56 41,345

Earnings From Operations ......... 5,373 (304) 5,069 67 (56) 5,080

Interest Expense ............... (241) — (241) — — (241)

Earnings Before Income Taxes ...... 5,132 (304) 4,828 67 (56) 4,839

Provision for Income Taxes ...... (1,832) 66 (1,766) 1 9 (1,756)

Net Earnings ..................... $ 3,300 $ (238) $ 3,062 $ 68 $ (47) $ 3,083

Basic Net Earnings per Common

Share ......................... $ 2.61 $(0.19) $ 2.42 $0.05 $(0.03) $ 2.44

Diluted Net Earnings per Common

Share ......................... $ 2.48 $(0.17) $ 2.31 $0.05 $(0.05) $ 2.31

Basic Weighted-Average Number of

Common Shares Outstanding ..... 1,265 — 1,265 — — 1,265

Dilutive Effect of Common Stock

Equivalents .................... 65 (2) 63 2 3 68

Diluted Weighted-Average Number of

Common Shares Outstanding ..... 1,330 (2) 1,328 2 3 1,333

(1) Includes $317 million of stock-based compensation and $89 million of deferred tax benefit associated with

the restatement of our historical APB 25 Consolidated Statement of Operations as well as an adjustment to

premium revenue of $1,113 million, medical costs of $1,016 million and operating costs of $97 million to

reflect a reinsurance contract on a gross basis to conform to our current presentation. We have also

reclassified certain service revenues and operating costs to product revenues and cost of products sold,

respectively, primarily related to our pharmacy benefit management business acquired as part of the

PacifiCare acquisition in December in 2005.

(2) Reflects $250 million of stock-based compensation and $90 million of deferred tax benefit as recorded

under the modified retrospective method of adoption of FAS 123R that would have been recognized based

on our original pro forma disclosure under FAS 123 prior to the restatement, net of the restatement

adjustments under APB 25.

(3) Represents adjustments made to restate our Consolidated Statement of Operations subsequent to the

adoption of FAS 123R under the modified retrospective method of adoption to correct the previously

presented pro forma disclosures for the effects of the historical stock option practices and includes $56

million of additional stock-based compensation and $9 million of related deferred tax benefit.

81