United Healthcare 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As further discussed in Note 10, we maintain a common stock repurchase program. The objective of our share

repurchase program is to optimize our capital structure, cost of capital and return to shareholders, as well as to

offset the dilutive impact of shares issued for stock-based award exercises.

Our Employee Stock Purchase Plan allows employees to purchase the Company’s stock at a discounted price

based on the lower of the price on the first day or the last day of the six-month purchase period. The

compensation expense is included in the compensation expense amounts recognized and discussed above. We

also offer a 401(k) plan for all employees of the Company. Compensation expense relating to this plan was not

significant in relation to our consolidated financial results in 2006, 2005 and 2004.

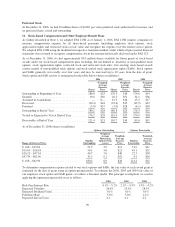

We have provided Supplemental Executive Retirement Plan benefits (SERPs), which are non-qualified defined

benefit plans, for our current CEO, former CEO and certain nonexecutive officer employees (which were

assumed in an acquisition). No additional amounts will accrue under the SERPs to our former CEO and current

CEO. The SERPs are non-contributory, unfunded and provide benefits based on years of service and

compensation during employment. Pension expense is determined using various actuarial methods to estimate the

total benefits ultimately payable to executives, and is allocated to service periods. The actuarial assumptions used

to calculate pension costs are reviewed annually. Pension expense was $4 million, $3 million and $9 million for

the years 2006, 2005 and 2004, respectively. The total SERP liability was $131 million and $128 million as of

December 31, 2006 and 2005, respectively, and is recorded within Other Long Term Liabilities in the

Consolidated Balance Sheets.

In addition, the Company maintains non-qualified, unfunded deferred compensation plans, which allow certain

senior management and executives to defer portions of their salary or bonus and receive certain Company

contributions on such deferrals, subject to plan limitations. The deferrals are recorded within Long-Term

Investments with an equal offsetting amount in Other Long-Term Liabilities in the Consolidated Balance Sheets.

The total deferrals are distributable based upon termination of employment or other periods as elected under the

plans, and are $212 million and $179 million as of December 31, 2006 and 2005, respectively.

As discussed in Note 3, the Company has restated its previously filed financial statements to reflect additional

stock-based compensation expense and related tax effects following an independent investigation of its historic

stock option practices.

12. Income Taxes

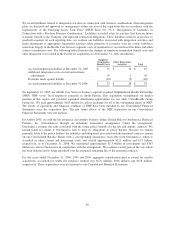

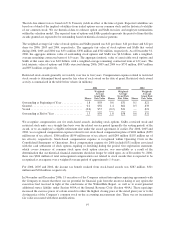

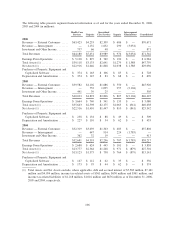

The components of the provision for income taxes are as follows:

Year Ended December 31, (in millions) 2006 2005 2004

Current Provision

Federal .......................................................... $2,236 $1,594 $1,166

State and Local .................................................... 158 125 89

Total Current Provision ......................................... 2,394 1,719 1,255

Deferred Provision ..................................................... (25) 37 64

Total Provision for Income Taxes ................................. $2,369 $1,756 $1,319

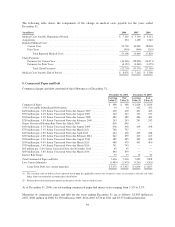

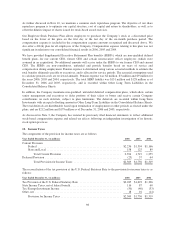

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes is as

follows:

Year Ended December 31, (in millions) 2006 2005 2004

Tax Provision at the U.S. Federal Statutory Rate ............................. $2,285 $1,693 $1,306

State Income Taxes, net of federal benefit ................................... 116 87 60

Tax-Exempt Investment Income .......................................... (50) (40) (33)

Other, net ............................................................ 18 16 (14)

Provision for Income Taxes .......................................... $2,369 $1,756 $1,319

98